THE imperialist phase of capitalist accumulation which implies universal competition comprises the industrialisation and capitalist emancipation of the hinterland where capital formerly realised its surplus value. Characteristic of this phase are: lending abroad, railroad constructions, revolutions, and wars. The last decade, from 1900 to 1910, shows in particular the world-wide movement of capital, especially in Asia and neighbouring Europe: in Russia, Turkey, Persia, India, Japan, China, and also in North Africa. Just as the substitution of commodity economy for a natural economy and that of capitalist production for a simple commodity production was achieved by wars, social crises and the destruction of entire social systems, so at present the achievement of capitalist autonomy in the hinterland and backward colonies is attained amidst wars and revolutions. Revolution is an essential for the process of capitalist emancipation. The backward communities must shed their obsolete political organisations, relics of natural and simple commodity economy, and create a modern state machinery adapted to the purposes of capitalist production. The revolutions in Turkey, Russia, and China fall under this heading. The last two, in particular, do not exclusively serve the immediate political requirements of capitalism; to some extent they carry over outmoded pre-capitalist claims while on the other hand they already embody new conflicts which run counter to the domination of capital. These factors account for their immense drive, but at the same time impede and delay the ultimate victory of the revolutionary forces. A young state will usually sever the leading strings of older capitalist states by wars, which temper and test the modern state’s capitalist independence in a baptism by fire. That is why military together with financial reforms invariably herald the bid for economic independence.

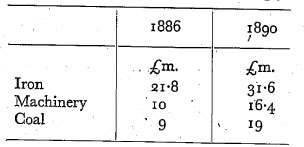

The forward-thrusts of capital are approximately reflected in the development of the railway network. The permanent way grew most quickly in Europe during the forties, in America in the fifties, in Asia in the sixties, in Australia during the seventies and eighties, and during the nineties in Africa.(1)

Public loans for railroad building and armaments accompany all stages of the accumulation of capital: the introduction of commodity economy, industrialisation of countries, capitalist revolutionisation of agriculture as well as the emancipation of young capitalist states. For the accumulation of capital, the loan has various functions: (a) it serves to convert the money of non-capitalist groups into capital, i.e. money both as a commodity equivalent (lower middle-class savings) and as fund of consumption for the hangers-on of the capitalist class; (b) it serves to transform money capital into productive capital by means of state enterprise-railroad building and military supplies; (c) it serves to divert accumulated capital from the old capitalist countries to young ones. In the sixteenth and seventeenth centuries, the loan transferred capital from the Italian cities to England, in the eighteenth century from Holland to England, in the nineteenth century from England to the American Republics and Australia, from France, Germany and Belgium to Russia, and at the present time [1912] from Germany to Turkey, from England, Germany and France to China, and, via Russia, to Persia.

In the Imperialist Era, the foreign loan played an outstanding part as a means for young capitalist states to acquire independence. The contradictions inherent in the modern system of foreign loans are the concrete expression of those which characterise the imperialist phase. Though foreign loans are indispensable for the emancipation of the rising capitalist states, they are yet the surest ties by which the old capitalist states maintain their influence, exercise financial control and exert pressure on the customs, foreign and commercial policy of the young capitalist states. Pre-eminently channels for the investment in new spheres of capital accumulated in the old countries, such loans widen the scope for the accumulation of capital; but at the same time they restrict it by creating new competition for the investing countries.

These inherent conflicts of the international loan system are a classic example of spatio-temporal divergencies between the conditions for the realisation of surplus value and the capitalisation thereof. While realisation of the surplus value requires only the general spreading of commodity production, its capitalisation demands the progressive supercession of simple commodity production by capitalist economy, with the corollary that the limits to both the realisation and the capitalisation of surplus value keep contracting ever more. Employment of international capital in the construction of the international railway network reflects this disparity. Between the thirties and the sixties of the nineteenth century, railway is building and the loans necessary for it mainly served to oust natural economy, and to spread commodity economy – as in the case of the Russian railway loans in the sixties, or in that of the American railways which were built with European capital. Railway construction in Africa and Asia during the last twenty years, on the other hand, almost exclusively served the purposes of an imperialist policy, of economic monopolisation and economic subjugation of the backward communities. As regards Russia’s railroad construction in Eastern Asia, for instance, it is common knowledge that Russia had paved the way for the military occupation of Manchuria by sending troops to protect her engineers working on the Manchurian railway. With the same object in view, Russia obtained railway concessions in Persia, Germany in Asia Minor and Mesopotamia, and Britain and Germany in Africa.

In this connection, we must deal with a misunderstanding concerning the capital investments in foreign countries and the demand of these countries for capital imports. Already in the early twenties of the last century, the export of British capital to America played an important part, being largely responsible for the first genuine industrial and commercial crises in England in 1825. Since 1824, the London stock exchange had been flooded with South American stocks and shares. During the following year, the newly defeated states of South and Central America raised loans in London alone for more than £20,000,000, and in addition, enormous quantities of South American industrial shares and similar bonds were sold. This sudden prosperity and the opening up of the South American markets in their turn called forth greatly increased exports of British commodities to the Latin Americas. British commodity exports to these countries amounted to £2,900,000 in 1821 which had risen to £6,400,000 by 1825.

Cotton textiles formed the most important item of these exports; this powerful demand was the impetus for a rapid expansion of British cotton production, and many new factories were opened. In 1821, raw cotton to the value of £m. 129 was made up in England and risen to £m. 167.

The situation was thus fraught with the elements of a crisis. Tugan Baranovski raises the question:

‘But from where did the South American countries take the means to buy twice as many commodities in 1825 as in 1821? The British themselves supplied these means. The loans floated on the London stock exchange served as payment for imported goods. Deceived by the demand they had themselves created, the British factory-owners were soon brought to realise by their own experience that their high expectations had been unfounded.’(2)

He thus characterises as ‘deceptive’, as an unhealthy, abnormal economic phenomenon the fact that the South American demand for English goods had been brought about by British capital. Thus uncritically he took over the doctrine of an expert with whose other theories he wished to have nothing in common. The opinion had been advanced already during the English crisis of 1825 that it could be explained by the ‘singular’ development of the relations between British capital and South American demand. None other than Sismondi had raised the same question as Tugan Baranovski and given a most accurate description of events in the second edition of his Nouveaux Principes:

‘The opening up of the immense market afforded by Spanish America to industrial producers seemed to offer a good opportunity to relieve British manufacture. The British government were of that opinion, and in the seven years following the crisis of 1818, displayed unheard-of activity to carry English commerce to penetrate the remotest districts of Mexico, Columbia, Brazil, Rio de la Plata, Chile and Peru. Before the government decided to recognise these new states, it had to protect English commerce by frequent calls of battleships whose captains had a diplomatic rather than a military mission. In consequence, it had defied the clamours of the Holy Alliance and recognised the new republics at a moment when the whole of Europe, on the contrary, was plotting their ruin. But however big the demand afforded by free America, yet it would not have been enough to absorb all the goods England had produced over and above the needs of consumption, had not their means for buying English merchandise been suddenly increased beyond all bounds by the loans to the new republics. Every American state borrowed from England an amount sufficient to consolidate its government. Although they were capital loans, they were immediately spent in the course of the year like income, that is to say they were used up entirely to buy English goods on behalf of the treasury, or to pay for those which had been dispatched on private orders. At the same time, numerous companies with immense capitals were formed to exploit all the American mines, but all the money they spent found its way back to England, either to pay for the machinery which they immediately used, or else for the goods sent to the localities where they were to work. As long as this singular commerce lasted, in which the English only asked the Americans to be kind enough to buy English merchandise with English capital, and to consume them for their sake, the prosperity of English manufacture appeared dazzling. It was no more income but rather English capital which was used to push on consumption: the English themselves bought and paid for their own goods which they sell to America, and thereby merely forwent the pleasure of using these goods.’(3)

From this Sismondi drew the characteristic conclusion that the real limits to the capitalist market are set by income, i.e. by personal consumption alone, and he used this example as one more warning against accumulation.

Down to the present day, the events which preceded the crisis of 1825 have remained typical for a period of boom and expansion of capital, and such ‘singular commerce’ is in fact one of the most important foundations of the accumulation of capital. Particularly in the history of British capital, it occurs regularly before every crisis, as Tugan Baranovski himself showed by the following facts and figures: the immediate cause of the 1836 crisis was the flooding of the American market with British goods, again financed by British money. In 1834, US commodity imports exceeded exports by £m. 12 but at the same time their imports of precious metal exceeded exports by nearly £m. 3.2. Even in 1836, the year of the crisis itself, their surplus of imported commodities amounted to £m. 10.4, and still the excess of bullion imported was £m 1. This influx of money, no less than the stream of goods, came chiefly from England, where US railway shares were bought in bulk. 1835/6 saw opening in the United States of sixty-one new banks with a capital of £m. 10.4, predominantly British. Again, the English paid for their exports themselves. The unprecedented industrial boom in the Northern States of the Union, eventually leading to the Civil War, was likewise financed by British capital, which again created an expanding market for British industry in the United States.

And not only British capital – other European capitals, also made every possible effort to take part in this ‘singular commerce’. To quote Schaeffle, in the five years between 1849 and 1854, at least £m. 100 were invested in American shares on the various stock exchanges of Europe. The simultaneous revival of world industry attained such dimensions that it culminated in the world crash of 1857. – In the sixties, British capital lost no time in creating similar conditions in Asia as well as the United States. An unending stream was diverted to Asia Minor and East India, where it financed the most magnificent railroad projects. The permanent way of British India amounted in 1860 to 844 miles, in 1870 to 4,802 miles, in 1880 to 9,361 miles and in 1890 to 16,875 miles. This at once increased the demand for British commodities. No sooner had the War of Secession come to a close, than British capital again flowed into the United States. It again paid for the greater part of the enormous railroad constructions in the Union during the sixties and seventies, the permanent way amounting in 1850 to 8,844 miles, in 1860 to 30,807 miles, in 1870 to 53,212 miles, in 1880 to 94,198 miles, and in 1890 to 179,005 miles. Materials for these railways were also being supplied by England – one of the main causes for the rapid development of the British coal and iron industries and the reasons why these industries were so seriously affected by the American crises of 1866, 1873 and 1884. What Sismondi considered sheer lunacy was in this instance literally true: the British with their own materials, their own iron etc., had built railroads in the United States, they had paid for the railways with their own capital and only forwent their ‘use’. In spite of all periodical crises, however, European capital had acquired such a taste for this madness, that the London stock exchange was seized by a veritable epidemic of foreign loans in the middle of the seventies. Between 1870 and 1875, loans of this kind, amounting to £m. 260, were raised in London. The immediate consequence was a rapid increase in the overseas export of British merchandise. Although the foreign countries concerned went periodically bankrupt, masses of capital continued to flow in. Turkey, Egypt, Greece, Bolivia, Costa Rica, Ecuador, Honduras, Mexico, Paraguay, Peru, St. Domingo, Uruguay, and Venezuela completely or partially suspended their payments of interest in the late seventies. Yet undeterred by this, the fever for exotic state loans burst out again at the end of the eighties – the South American states and South African colonies were lent immense quantities of European capital. In 1874, for instance, the Argentine Republic borrowed as much as £m. 10 and the loan had risen to £m. 59 by 1890.

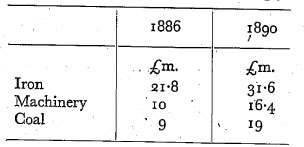

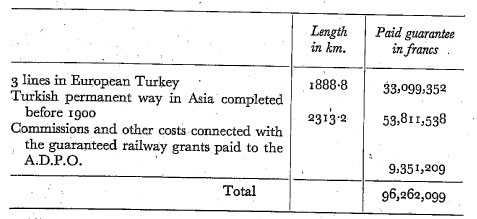

England built railways with her own iron and coal in all these countries as well, paying for them with her own capital. In 1885, the Argentine permanent way had been 1,952 miles, in 1893 it was 8,557 miles. Exports from England were rising accordingly:

|

British total exports (mainly to the Argentine) amounted to £m. 47 in 1885 and to £m. 10.7 a mere four years later.

At the same time, British capital flowed into Australia in the form of state loans. At the end of the eighties the loans to the three colonies Victoria, New South Wales and Tasmania amounted to £m.112, £m. 81 of which were invested in railway construction. The permanent way of Australia extended over 4,900 miles in 1880, and over 15,600 miles in 1895.

Britain, supplying capital and materials for these railways, was also embroiled in the crises of 1890 in the Argentine, Transvaal, Mexico, Uruguay, and in that of 1893 in Australia.

The following two decades made a difference only in so far as German, French and Belgian capital largely participated with British capital in foreign investments, while railway construction in Asia Minor had been financed entirely by British capital from the fifties to the late eighties. From then on, German capital took over and put into execution the tremendous project of the Anatolian railway. German capital investments in Turkey gave rise to an increased export of German goods to that country.

In 1896, German exports to Turkey amounted to £m. 14, in 1911 to £m. 5.65. To Asiatic Turkey, in particular, goods were exported in 1901 to the value of £m. 0.6 and in 1911 to the value of £m. 1.85. In this case, German capital was used to a considerable extent to pay for German goods, the Germans forgoing, to use Sismondi’s term, only the pleasure of using their own products.

Let us examine the position more closely:

Realised surplus value, which cannot be capitalised and lies idle in England or Germany, is invested in railway construction, water works, Etc. in the Argentine, Australia, the Cape Colony or Mesopotamia. Machinery, materials and the like are supplied by the country where the capital has originated, and the same capital pays for them. Actually, this process characterises capitalist conditions everywhere, even at home. Capital must purchase the elements of production and thus become productive capital before it can operate. Admittedly, the products are then used within the country, while in the former case they are used by foreigners. But then capitalist production does not aim at its products being enjoyed, but at the accumulation of surplus value. There had been no demand for the surplus product within the country, so capital had lain idle without the possibility of accumulating. But abroad, where capitalist production has not yet developed, there has come about, voluntarily or by force, a new demand of the non-capitalist strata. The consumption of the capitalist and working classes at home is irrelevant for the purposes of accumulation, and what matters to capital is the very fact that its products are ‘used’ by others. The new consumers must indeed realise the products, pay for their use, and for this they need money. They can obtain some of it by the exchange of commodities which begins at this point, a brisk traffic in goods following hard on the heels of railway construction and mining (gold mines, etc.). Thus the capital advanced for railroad building and mining, together with an additional surplus value, is gradually realised. It is immaterial to the situation as a whole whether this exported capital becomes share capital in new independent enterprises, or whether, as a government loan, it uses the mediation of a foreign state to find new scope for operation in industry and traffic, nor does it matter if in the first case some of the companies are fraudulent and fail in due course, or if in the second case the borrowing state finally goes bankrupt, i.e. if the owners sometimes lose part of their capital in one way or another. Even the country of origin is not immune, and individual capitals frequently get lost in crises. The important point is that capital accumulated in the old country should find elsewhere new opportunities to beget and realise surplus value, so that accumulation can proceed. In the new countries, large regions of natural economy are open to conversion into commodity economy, or existing commodity economy can be ousted by capital. Railroad construction and mining, gold mining in particular, are typical for the investment of capitals from old capitalist countries in new ones. They are pre-eminently qualified to stimulate a brisk traffic in goods under conditions hitherto determined by natural economy and both are significant in economic history as mile-stones along the route of rapid dissolution of old economic organisations, of social crises and of the development of modern conditions, that is to say of the development of commodity economy to begin with, and further of the production of capital.

For this reason, the part played by lending abroad as well as by capital investments in foreign railway and mining shares is a fine sample of the deficiencies in Marx’s diagram of accumulation. In these instances, enlarged reproduction of capital capitalises a surplus value That has already been realised (in so far as the loans or foreign investments are not financed by the savings of the petty bourgeoisie or the semi-proletariat). It is quite irrelevant to the present field of accumulation, when, where and how the capital of the old countries has been realised so that it may flow into the new country. British capital which finds an outlet in Argentine railway construction might well in the past have been realised in China in the form of Indian opium. Further, the British capital which builds railways in the Argentine, is of English origin not only in its pure value-form, as money capital, but also in its material form, as iron, coal and machinery; the use-form of the surplus value, that is to say, has also come into being from the very beginning in the use-form suitable for the purposes of accumulation. The actual use-form of the variable capital, however, labour power, is mainly foreign: it is the native labour of the new countries which is made a new object of exploitation by the capital of the old countries. If we want to keep our investigation all on one plane, we may even assume that the labour power, too, has the same country of origin as the capital. In point of fact new discoveries, of gold mines for instance, tend to call forth mass emigration from the old countries, especially in the first stages, and are largely worked by labour from those countries. It might well be, then, that in a new country capital, labour power and means of production all come from the same capitalist country, say England. So it is really in England that all the material conditions for accumulation exist – a realised surplus value as money capital, a surplus product in productive form, and lastly labour reserves. Yet accumulation cannot proceed here: England and her old buyers require neither railways nor an expanded industry. Enlarged reproduction, i.e. accumulation, is possible only if new districts with a non-capitalist civilisation, extending over large areas, appear on the scene and augment the number of consumers.

But then, who are these new consumers actually; who is it that realises the surplus value of capitalist enterprises which are started with foreign loans; and who, in the final analysis, pays for these loans? The international loans in Egypt provide a classical answer.

The internal history of Egypt in the second half of the nineteenth century is characterised by the interplay of three phenomena: large-scale capitalist enterprise, a rapidly growing public debt, and the collapse of peasant economy. Until quite recently, corvée prevailed in Egypt, and the Wali and later the Khedive freely pursued their own power policy with regard to the condition of landownership. These primitive conditions precisely offered an incomparably fertile soil for the operations of European capital. Economically speaking, the conditions for a monetary economy had to be established to begin with, and the state created them by direct compulsion. Until the thirties, Mehemet Ali, the founder of Modern Egypt, here applied a method of patriarchal simplicity: every year, he ‘bought up’ the fellaheen’s entire harvest for the public exchequer, and allowed them to buy back, at a higher price, a minimum for subsistence and seed. In addition he imported cotton from East India, sugar cane from America, indigo and pepper, and issued the fellaheen with official directions what to plant and how much of it. The government again claimed the monopoly for cotton and indigo, reserving to itself the exclusive right of buying and selling these goods. By such methods was commodity exchange introduced in Egypt. Admittedly, Mehemet Ali also did something towards raising labour productivity. He arranged for dredging of the ancient canalisation, and above all he started the work of the great Kaliub Nile dams which initiated the series of great capitalist enterprises in Egypt. These were to comprise four great fields:

With the building of the Suez Canal, Egypt became caught up in the web of European capitalism, never again to get free of it. French capital led the way with British capital hard on its heels. In the twenty years that followed, the internal disturbances in Egypt were coloured by the competitive struggle between these two capitals. French capital was perhaps the most peculiar exponent of the European methods of capital accumulation at the expense of primitive conditions. Its operations were responsible for the useless Nile dams as well as for the Suez Canal. Egypt first contracted to supply the labour of 20,000 serfs free of charge for a number of years, and secondly to take up shares in the Suez Company to the tune of £m. 3.5, i.e. 40 per cent of the company's total capital. All this for the sake of breaking through a canal which would deflect the entire trade between Europe and Asia from Egypt and would painfully affect her part in this trade. These £m. 3.5 formed the nucleus for Egypt’s immense national debt which was to bring about her military occupation by Britain twenty years later. In the irrigation system, sudden transformations were initiated: the ancient sakias, i.e. bullock-driven water-wheels, of which 50,000 had been busy for 7 months in the year in the Nile delta alone, were partially replaced by steam pumps. Modern steamers now plied on the Nile between Cairo and Assuan. But the most profound change in the economic conditions of Egypt was brought about by the cultivation of cotton. This became almost epidemic in Egypt when, owing to the American War of Secession and the English cotton famine, the price per short ton rose from something between £30 and £40 to £200–£250. Everybody was planting cotton, and foremost among all, the Viceroy and his family. His estates grew fat, what with large-scale land robbery, confiscations, forced ‘sale’ or plain theft. He suddenly appropriated villages by the score though without any legal excuse. Within an incredibly short time, this vast demesne was brought under cotton, with the result that the entire technique of Egyptian traditional agriculture was revolutionised. Dams were thrown up everywhere to protect the cotton fields from the seasonal flooding of the Nile, and a comprehensive system of artificial irrigation was introduced. These waterworks together with continuous deep ploughing – a novel departure for the fellah who had until then merely scratched his soil with a plough dating back to the Pharaohs – and finally the intensive labours of the harvest made between them enormous demands on Egypt’s labour power. This was throughout the same forced peasant labour over which the state claimed to have an unrestricted right of disposal; and thousands had already been employed on the Kaliub dams and the Suez Canal and now the irrigation and plantation work to be done on the viceregal estates clamoured for this forced labour. The 20,000 serfs who had been put at the disposal of the Suez Canal Company were now required by the Khedive himself; and this brought about the first clash with French capital. The company was adjudged a compensation of £m. 3.35 by the arbitration of Napoleon III, a settlement to which the Khedive could all the more readily agree, since the very fellaheen whose labour power was the bone of contention were ultimately to be mulcted of this sum. The work of irrigation was immediately put in hand. Centrifugal machines, steam and traction engines were therefore ordered from England and France. In their hundreds, they were carried by steamers from England to Alexandria and then further. Steam ploughs were needed for cultivating the soil, especially since the rinderpest of 1864 had killed off all the cattle, England again being the chief supplier of these machines. The Fowler works were expanded enormously of a sudden to meet the requirements of the Viceroy for which Egypt had to pay.(4)

But now Egypt required yet a third type of machine, cotton gins and presses for packing. Dozens of these gins were set up in the Delta towns. Like English industrial towns, Sagasis, Tanta, Samanud and other towns were covered by pails of smoke and great fortunes circulated in the banks of Alexandria and Cairo.

But already in the year that followed this cotton speculation collapsed with the cotton prices which fell in a couple of days from 27d. per pound to 15d., 12d., and finally 6d. after the cessation of hostilities in the American Union. The following year, Ismail Pasha ventured on a new speculation, the production of cane sugar. The forced labour of the fellaheen was to compete with the Southern States of the Union where slavery had been abolished. For the second time, Egyptian agriculture was turned upside down. French and British capitalists found a new field for rapid accumulation. 18 giant sugar factories were put on order in 1868–9 with an estimated daily output of 200 short tons of sugar, that is to say four times as much as that of the greatest then existing plant. Six of them were ordered from England, and twelve from France, but England eventually delivered the lion’s share, because of the Franco-German war. These factories were to be built along the Nile at intervals of 6.2 miles (10 km.), as centres of cane plantations of an area comprising 10 sq. km. Working to full capacity, each factory required a daily supply of 2,000 tons of sugar cane. Fellaheen were driven to forced labour on the sugar plantations in their thousands, while further thousands of their number built the Ibrahimya Canal. The stick and kourbash were unstintingly applied. Transport soon became a problem. A railway network had to be built round every factory to haul the masses of cane inside, rolling stock, funiculars, etc., had to be obtained as quickly as possible. Again these enormous orders were placed with English capital. The first giant factory was opened in 1872, 4,000 camels providing makeshift transport. But it proved to be simply impossible to supply cane in the quantities required by the undertaking. The working staff was completely inadequate, since the fellah, accustomed to forced labour on the land, could not be transformed overnight into a modern industrial worker by the lash of the whip. The venture collapsed, even before many of the imported machines had been installed. This sugar speculation concluded the period of gigantic capitalist enterprise in Egypt in 1873.

What had provided the capital for these enterprises? International loans. One year before his death in 1863, Said Pasha had raised the first loan at a nominal value of £m. 3.3 which came to £m. 2.5 in cash after deduction of commissions, discounts, etc. He left to Ismail Pasha the legacy of this debt and the contract with the Suez Canal Company, which was to burden Egypt with a debt of £m. 17. Ismail Pasha in turn raised his first loan in 1864 with a nominal value of £m. 5.7 at 7 per cent and a cash value of £m. 485 at 8¼ per cent. What remained of it, after £m. 3.35 had been paid to the Suez Canal Company as compensation, was spent within the year, swallowed up for the greater part by the cotton gamble. In 1865, the first so-called Daira-loan was floated by the Anglo-Egyptian Bank, on the security of the Khedive’s private estates. The nominal value of this loan was £m. 3.4 at 9 per cent, and its real value £m. 2.5 at 12 per cent. In 1866, Fruehling & Goschen floated a new loan at a nominal value of £m. 3 and a cash value of £m. 2. The Ottoman Bank floated another in 1867 of nominally £m. 2, really £m. 1.7. The floating debt at that time amounted to £m. 30. The Banking House Oppenheim & Neffen floated a great loan in 1868 to consolidate part of this debt. Its nominal value was £m. 11.9 at 7 per cent, though Ismail could actually lay hands only on £m. 7.1 at 13½ percent. This money made it possible, however, to pay for the pompous celebrations on the opening of the Suez Canal, in presence of the leading figures in the Courts of Europe, in finance and in the demi-monde, for a madly lavish display, and further, to grease the palm of the Turkish Overlord, the Sultan, with a new baksheesh of £m. 1. The sugar gamble necessitated another loan in 1870. Floated by the firm of Bischoffsheim & Goldschmidt, it had a nominal value of £m. 7.1 at 7 per cent, and its cash value was £m. 5. In 1872/3 Oppenheim’s floated two further loans, a modest one amounting to £m. 4 at 14 per cent and a large one of £m. 32 at 8 per cent which reduced the floating debt by one half, but which actually came only to £m 11 in cash, since the European banking houses paid it in part by bills of exchange they had discounted.

In 1874, a further attempt was made to raise a national loan of £m. 50 at an annual charge of 9 per cent., but it yielded no more than £m. 3.4. Egyptian securities were quoted at 54 per cent of their face value. Within the thirteen years after Said Pasha’s death, Egypt’s total public debt had grown from £m. 3.293 to £m. 94.110,(5) and collapse was imminent.

These operations of capital, at first sight, seem to reach the height of madness. One loan followed hard on the other, the interest on old loans was defrayed by new loans, and capital borrowed from the British and French paid for the large orders placed with British and French industrial capital.

While the whole of Europe sighed and shrugged its shoulders at Ismail’s crazy economy, European capital was in fact doing business in Egypt on a unique and fantastic scale – an incredible modern version of the biblical legend about the fat kine which remains unparalleled in capitalist history.

In the first place, there was an element of usury in every loan, anything between one-fifth and one-third of the money ostensibly lent sticking to the fingers of the European bankers. Ultimately, the exorbitant interest had to be paid somehow, but how – where were the means to come from? Egypt herself was to supply them; their source was the Egyptian fellah–peasant economy providing in the final analysis all the most important elements for large-scale capitalist enterprise. He provided the land since the so-called private estates of the Khedive were quickly growing to vast dimensions by robbery and blackmail of innumerable villages; and these estates were the foundations of the irrigation projects and the speculation in cotton and sugar cane. As forced labour, the fellah also provided the labour power and, what is more, he was exploited without payment and even had to provide his own means of subsistence while he was at work. The marvels of technique which European engineers and European machines performed in the sphere of Egyptian irrigation, transport, agriculture and industry were due to this peasant economy with its fellaheen serfs. On the Kaliub Nile dams and on the Suez Canal, in the cotton plantations and in the sugar plants, untold masses of peasants were put to work; they were switched over from one job to the next as the need arose, and they were exploited to the limit of endurance and beyond. Although it became evident at every step that there were technical limits to the employment of forced labour for the purposes of modern capital, yet this was amply compensated by capital’s unrestricted power of command over the pool of labour power, how long and under what conditions men were to work, live and be exploited.

But not alone that it supplied land and labour power, peasant economy also provided the money. Under the influence of capitalist economy, the screws were put on the fellaheen by taxation. The tax on peasant holdings was persistently increased. In the late sixties, it amounted to £2 5s. per hectare, but not a farthing was levied on the enormous private estates of the royal family. In addition, ever more special rates were devised. Contributions of 2s. 6d. per hectare had to be paid for the maintenance of the irrigation system which almost exclusively benefited the royal estates, and the fellah had to pay 1s. 4d. for every date tree felled, 9d. for every clay hovel in which he lived. In addition, every male over 10 years of age was liable to a head tax of 6s. 6d. The total paid by the fellaheen was £m. 2.5 under Mehemet Ali, £m. 5 under Said Pasha, and £m. 8.15 under Ismail Pasha.

The greater the debt to European capital became, the more had to be extorted from the peasants.(6) In 1869 all taxes were put up by 10 per cent and the taxes for the coming year collected in advance. In 1870, a supplementary land tax of 8s. per hectare was levied. All over Upper Egypt people were leaving the villages, demolished their dwellings and no longer tilled their land – only to avoid payment of taxes. In 1876, the tax on date palms was increased by 6d. Whole villages went out to fell their date palms and had to be prevented by rifle volleys. North of Siut, 10,000 fellaheen are said to have starved in 1879 because they could no longer raise the irrigation tax for their fields and had killed their cattle to avoid paying tax on it.(7)

Now the fellah had been drained of his last drop of blood. Used as a leech by European capital, the Egyptian state had accomplished its function and was no longer needed. Ismail, the Khedive, was given his congé; capital could begin winding up operations.

Egypt had still to pay 394,000 Egyptian pounds as interest on the Suez Canal shares for £m. 4 which England had bought in 1875. Now British commissions to ‘regulate’ the finances of Egypt went into action. Strangely enough, European capital was not at all deterred by the desperate state of the insolvent country and offered again and again to grant immense loans for the salvation of Egypt. Cowe and Stokes proposed a loan of £m. 76 at 9 per cent for the conversion of the total debt, Rivers Wilson thought no less than £m. 503 would be necessary. The Crédit Foncier bought up floating bills of exchange by the million, attempting, though without success, to consolidate the total debt by a loan of £m. 91. With the financial position growing hopelessly desperate, the time drew near when the country and all her productive forces was to become the prey of European capital. October 1878 saw the representatives of the European creditors landing in Alexandria. British and French capital established dual control of finances and devised new taxes; the peasants were beaten and oppressed, so that payment of interest, temporarily suspended in 1876, could be resumed in 1877.(8)

Now the claims of European capital became the pivot of economic life and the sole consideration of the financial system. In 1878, a new commission and ministry were set up, both with a staff in which Europeans made up one half. In 1879, the finances of Egypt were brought under permanent control of European capital, exercised by the Commission de la Dette Publique Égyptienne in Cairo. In 1878, the Tshiffiks, estates of the viceregal family, which comprised 431,100 acres, were converted into crown land and pledged to the European capitalists as collateral for the public debt, and the same happened to the Daira lands, the private estates of the Khedive, comprising 485,131 acres, mainly in Upper Egypt; this was, at a later date, sold to a syndicate. The other estates for the greatest part fell to capitalist companies, the Suez Canal Company in particular. To cover the cost of occupation, England requisitioned ecclesiastical lands of the mosques and schools. An opportune pretext for the final blow was provided by a mutiny in the Egyptian army, starved under European financial control while European officials were drawing excellent salaries, and by a revolt engineered among the Alexandrian masses who had been bled white. The British military occupied Egypt in 1882, as a result of twenty years’ operations of Big Business, never to leave again. This was the ultimate and final step in the process of liquidating peasant economy in Egypt by and for European capital.(9)

It should now be clear that the transactions between European loan capital and European industrial capital are based upon relations which are extremely rational and ‘sound’ for the accumulation of capital, although they appear absurd to the casual observer because this loan capital pays for the orders from Egypt and the interest on one loan is paid out of a new loan. Stripped of all obscuring connecting links, these relations consist in the simple fact that European capital has largely swallowed up the Egyptian peasant economy. Enormous tracts of land, labour, and labour products without number, accruing to the state as taxes, have ultimately been converted into European capital and have been accumulated. Evidently, only by use of the kourbash could the historical development which would normally take centuries be compressed into two or three decades, and it was just the primitive nature of Egyptian conditions which proved such fertile soil for the accumulation of capital.

As against the fantastic increase of capital on the one hand, the other economic result is the ruin of peasant economy together with the growth of commodity exchange which is rooted in the supreme exertion of the country’s productive forces. Under Ismail’s rule, the arable and reclaimed land of Egypt grew from 5 to 6.75 million acres, the canal system from 45,625 to 54,375 miles and the permanent way from 256.25 to 1,638 miles. Docks were built in Siut and Alexandria, magnificent dockyards in Alexandria, a steamer-service for pilgrims to Mecca was introduced on the Red Sea and along the coast of Syria and Asia Minor. Egypt’s exports which in 1861 had amounted to 4,450,000 rose to £m. 14.4 in 1864; her imports which under Said Pasha amounted to £m. 1.2 rose under Ismail to between £m. 5 and £m. 5.5. Trade which recovered only in the eighties from the opening up of the Suez Canal amounted to £m. 8.15 worth of imports and £m. 12.45 worth of exports in 1890, but in 1900 the figures were £m. 144 for imports and £m. 12.25 for exports, and in 1911 – £m. 27.85 for imports and £m. 26.85 for exports. Thanks to this development of commodity economy which expanded by leaps and bounds with the assistance of European capital, Egypt herself had fallen a prey to the latter. The case of Egypt, just as that of China and, more recently, Morocco, shows militarism as the executor of the accumulation of capital, lurking behind international loans, railroad building, irrigation systems, and similar works of civilisation. The Oriental states cannot develop from natural to commodity economy and further to capitalist economy fast enough and are swallowed up by international capital, since they cannot perform these transformations without selling their souls to capital. Their feverish metamorphoses are tantamount to their absorption by international capital.

Another good recent example is the deal made by German capital in Asiatic Turkey. European capital, British capital in particular, had already at an early date attempted to gain possession of this area which marches with the ancient trade route between Europe and Asia.(10)

In the fifties and sixties, British capital built the railway lines Smyrna–Aydin–Diner and Smyrna–Kassab–-Alasehir, obtained the concession to extend the line to Afyon Karahisar and also leased the first tract for the Anatolian railway Ada–Bazar–Izmid. French capital gradually came to acquire influence over part of the railway building during this time. In 1888, German capital appeared on the scene. It took up 60 per cent of the shares in the new merger of international interests, negotiated principally with the French capitalist group represented by the Banque Ottomane. International capital took up the remaining 40 per cent.(11) The Anatolian Railway Company, a Turkish company, was founded on the 14th Redsheb of the year 1306 (March 4, 1889) with the Deutsche Bank for principal backer, to take over the railway lines: between Ada-Bazar and Izmid, running since the early seventies, as also the concession for the Izmid–Eskisehir–Angora line (25 miles). It was further entitled to complete the Ada–Bazar–Scutari line and branch lines to Brussa, in addition to building the supplementary network Eskisehir–Konya (278 miles) on the basis of the 1893 concession, and finally to run a service from Angora to Kaisari (264 miles). The Turkish government gave the company a state guarantee of annual gross earnings amounting to £412 per km. on the Ada-Bazar line and of £600 per km. on the Izmid–Angora lines. For this purpose it wrote over to the Administration de la Dette Publique Ottomane the revenue from tithes in the sandshaks of Izmid, Ertoghrul, Kutalia and Angora, with which to make up the gross earnings guaranteed by the government. For the Angora-Kaisari line the government guaranteed annual gross earnings of 775 Turkish pounds, i.e. £712 per km., and 604 Turkish pounds, i.e. approximately £550, provided, in the latter case, that the supplementary grant per km. did not exceed 219 Turkish pounds (£200 a year). The government was to receive a quarter of the eventual surplus of gross earnings over the guaranteed amount. The Administration de la Dette Publique Ottomane as executor of the government guarantee collected the tithes of the sandshaks Trebizonde and Gumuchhane direct and aid the railway company out of a common fund which was formed of all the tithes set aside for this purpose. In 1898, the Eskisehir–Konya maximum grant was raised from 218 to 296 Turkish pounds.

In 1899, the company obtained concessions to build and run a dockyard at Ada-Bazar, to issue writs, to build corn-elevators and storerooms for goods of every description, further the right to employ its own staff for loading and unloading and, finally, in the sphere of customs policy, the creation of a kind of free port.

In 1901, the company acquired a concession for the Baghdad railway Konya–Baghdad–Bazra–Gulf of Persia (1,500 miles) which connects with the Anatolian line by the Konya–Aregli–Bulgurlu line. For taking up this concession, a new limited company was founded which placed the order of constructing the line, at first to Bulgurlu, with a Building Company registered in Frankfort-on-the-Main.

Between 1893 and 1910, the Turkish government gave additional grants – £1,948,000 for the Ada-Bazar–Angora line and 1,800,000 Turkish pounds for the Eskisehir–Konya line – a total of £3,632,000.(12) Finally, by the concession of 1907, the company was empowered to drain the Karavirar Lake and to irrigate the Konya plain, these works to be executed within six years at government expense. In this instance, the company advanced the government the necessary capital up to £780,000 at per cent interest, repayable within thirty-six years. In return the Turkish government pledged as securities:

For the execution of this work, the Frankfort company had formed a subsidiary company ‘for the irrigation of the Konya plain’ with a capital of £m. 5.4 to take this work in hand.

In 1908 the company obtained the concession for extending the Konya railway as far as Baghdad and the Gulf of Persia, again with inclusion of a guaranteed revenue.

To pay for this railway grant, a German Baghdad railway loan was taken up in three instalments of £m. 216, £m. 432 and £m. 476 respectively, on the security of the aggregate tithes for the vilayets Aydin, Baghdad, Mossul, Diarbekir, Ursa and Alleppo, and the sheep-tax in the vilayets Konya, Adana, Aleppo, etc.(13)

The foundation of accumulation here becomes quite clear. German capital builds railways, ports and irrigation works in Asiatic Turkey; in all these enterprises it extorts new surplus value from the Asiatics whom it employs as labour power. But this surplus value must be realised together with the means of production from Germany, (railway materials; machinery, etc.) How is it done? In part by commodity exchange which is brought about by the railways, the dockyards, etc., and nurtured in Asia Minor under conditions of natural economy. In part, i.e. in so far as commodity exchange does not grow quickly enough for the needs of capital, by using force, the machinery of the state, to convert the national real income into commodities; these are turned into cash in order to realise capital plus surplus value. That is the true object of the revenue grants for independent enterprises run by foreign capital, and of the collateral in the case of loans. In both instances so-called tithes (ueshur), pledged in different ways, are paid in kind by the Turkish peasant and these were gradually increased from about 12 to 12.5 per cent. The peasant in the Asiatic vilayet must pay up or else his tithe would simply be confiscated by the police and the central and local authorities. These tithes, themselves a manifestation of ancient Asiatic despotism based on natural economy, are not collected by the Turkish government direct; but by tax-farmers not unlike the tax-collectors of the ancien régime; that is to say the expected returns from the levy in each vilayet are separately auctioned by the state to tax-farmers. They are bought by individual speculators or syndicates who sell the tithes of each sandshak (district) to other speculators and these resell their shares to a whole number of smaller agents. All these middlemen want to cover their expenses and make the greatest possible profit, and thus, by the time they are actually collected, the peasants’ contributions have swollen to enormous dimensions. The tax-farmer will try to recoup himself for any mistake in his calculations at the expense of the peasant, and the latter, nearly always in debt, is impatient for the moment when he can sell his harvest. But often, after cutting his corn, he cannot start threshing for weeks, until indeed the tax-farmer deigns to take his due. His entire harvest is about to rot in the fields, and the tax-farmer, usually a grain merchant himself, takes advantage of this fact and compels him to sell at a low price. These tax collectors know how to enlist the support of the officials, especially the Muktars, the local headmen, against complaining malcontents.(14)

Along with the taxes on salt, tobacco, spirits, the excise on silk, the fishing dues, etc., the tithes are pledged with the Conseil de l’Administration de la Dette Publique Ottomane to serve as security for the railway grant and the loans. In every case the Conseil reserves to itself the right to vet the tax-farmers’ contracts and stipulates for the proceeds of the tithe to be paid directly into the coffers of its regional offices. If no tax-farmer can be found, the tithes are stored in kind by the Turkish government; the warehouse keys are deposited with the Conseil which then can sell the tithes on its own account.

Thus the economic metabolism between the peasants of Asia Minor, Syria and Mesopotamia on the one hand and German capital on the other proceeds in the following way: in the vilayets Konya, Baghdad, Bazra, etc., the grain comes into being as a simple use-product of primitive peasant economy. It immediately falls to the tithe-farmer as a state levy. Only then, in the hands of this latter, does it become a commodity, and, as such, money which falls to the state. This money is nothing but converted peasant grain; it was not even produced as a commodity. But now, as a state guarantee, it serves towards paying for the construction and operation of railways, i.e. to realise both the value of the means of production and the surplus value extorted from the Asiatic peasants and proletariat in the building and running of the railway. In this process further means of production of German origin are used, and so the peasant grain of Asia, converted into money, also serves to turn into cash the surplus value that has been extorted from the German workers. In the performance of these functions, the money rolls from the hands of the Turkish government into the coffers of the Deutsche Bank, and here it accumulates, as capitalist surplus value, in the form of promoters’ profits, royalties, dividends and interests in the accounts of Messrs. Gwinner, Siemens, Stinnes and their fellow directors, of the shareholders and clients of the Deutsche Bank and the whole intricate system of its subsidiary companies. If there is no tax-farmer, as provided in the concessions, then the complicated metamorphoses are reduced to their most simple and obvious terms: the peasant grain passes immediately to the Administration de la Dette Publique Ottomane, i.e. to the representatives of European capital, and becomes already in its natural form a revenue for German and other foreign capital: it realises capitalist surplus value even before it has shed its use-form for the Asiatic peasant, even before it has become a commodity and its own value has been realised. This is a coarse and straightforward metabolism between European capital and Asiatic peasant economy, with the Turkish state reduced to its real role, that of a political machinery for exploiting peasant economy for capitalist purposes, – the real function, this, of all Oriental states in the period of capitalist imperialism. This business of paying for German goods with German capital in Asia is not the absurd circle it seems at first, with the kind Germans allowing the shrewd Turks merely the ‘use’ of their great works of civilisation – it is at bottom an exchange between German capital and Asiatic peasant economy, an exchange performed under state compulsion. On the one hand it makes for progressive accumulation and expanding ‘spheres of interest’ as a pretext for further political and economic expansion of German capital in Turkey. Railroad building and commodity exchange, on the other hand, are fostered by the state on the basis of a rapid disintegration, ruin and exploitation of Asiatic peasant economy in the course of which the Turkish state becomes more and more dependent on European capital, politically as well as financially.(15)

|

(2) Tugan Baranovski, Studies on the Theory and History of Commercial Crises in England, p.74.

(3) Sismondi, Nouveaux Principes ..., vol.i, book iv, chap.iv: Commercial Wealth Follows the Growth of Income, pp.368-70.

(4) Engineer Eyth, a representative of Fowler’s, tells us: ‘Now there was a feverish exchange of telegrams between Cairo, London and Leeds. – “When can Fowler’s deliver 150 steam ploughs?” – Answer: “Working to capacity, within one year.” – “Not good enough. Expect unloading Alexandria by spring 150 steam ploughs.” – A.: “Impossible.” – The works at that time were barely big enough to turn out 3 steam ploughs per week. N.B. a machine of this type costs £2,500 so that the order involved £m. 3.75. Ismail Pasha’s next wire: “Quote cost immediate factory expansion. Viceroy willing foot bill.” – You can imagine that Leeds made hay while the sun shone. And in addition, other factories in England and France as well were made to supply steam ploughs. The Alexandria warehouses, where goods destined for the vice-regal estates were unloaded, were crammed to the roof with boilers, wheels, drums wire-rope and all sorts of chests and boxes. The second-rate hostelries of Cairo swarmed with newly qualified steam ploughmen, promoted in a hurry from anvil or share-plough, young hopefuls, fit for anything and nothing, since every steam plough must be manned by at least an expert pioneer of civilization. Wagon loads of this assorted cargo were sent into the interior, just so that the next ship could unload. You cannot imagine in what condition they arrived at their destination, or rather anywhere but their destination. Ten boilers were lying on the banks of the Nile, and the machine to which they belonged was ten miles thither. Here was a little heap of wire-rope, but you had to travel another 20 hours to find the appropriate pulleys. In one place an Englishman who was to set up the machines squatted desolate and hungry, on a pile of French crates, and in another place the mate had taken to native liquor in his despair. Effendis and Katibs, invoking the help of Allah, rushed to and fro between Siut and Alexandria and compiled endless lists of items the names of which they did not even know. And yet, in the end, some of this apparatus was set in motion in Upper Egypt, the ploughs belched steam – civilisation and progress had made another step forward’ (Lebendige Kräfte, 7 Vorträge aus dem Gebiete der Technik, Berlin 1908, p.21)

(5) Cf. Evelyn Baring, Earl of Cromer, Egypt Today (London 1908), vol.i, p.11.

(6) Incidentally, the money wrested from the Egyptian fellah further fell, by way of Turkey, to European capital. The Turkish loans of 1854, 1855, 1871, 1877 and 1886 were based on the contributions from Egypt which were increased several times and paid direct into the Bank of England.

(7) ‘It is stated by residents in the Delta’, reports The Times of March 31, 1879, ‘that the third quarter of the year’s taxation is now collected, and the old methods of collection applied. This sounds strangely by the side of the news that people are starving by the roadside, that great tracts of country are uncultivated, because of the physical burdens, and that the farmers have sold their cattle, the women their finery, and that the usurers are filling the mortgage offices with their bonds, and the courts with their suits of foreclosure’ (quoted by Th. Rothstein, Egypt’s Ruin, 1910, pp.69-70).

(8) ‘This produce’, wrote the correspondent of The Times from Alexandria, ‘consists wholly of taxes paid by the peasants in kind, and when one thinks of the poverty-stricken, overdriven, under-paid fellaheen in their miserable hovels, working late and early to fill the pockets of the creditors, the punctual payment of the coupon ceases to be wholly a subject of gratification’ (quoted by Rothstein, op. cit., p.49).

(9) Eyth, an outstanding exponent of capitalist civilisation in the primitive countries, characteristically concludes his masterly sketch on Egypt, from which we have taken the main data, with the following imperialist articles of faith: ‘What we have learnt from the past also holds true for the future. Europe must and will lay firm hands upon those countries which can no longer keep up with modern conditions on their own, though this will not be possible without all kinds of struggle, when the difference between right and wrong will become blurred, then political and historical justice will often enough mean disaster for millions and their salvation depend upon what is politically wrong. All the world over, the strongest hand will make an end to confusion, and so it will even on the banks of the Nile’ (op. cit., p.247). Rothstein has made it clear enough what kind of ‘order’ the British created ‘on the banks of the Nile’.

(10) Already in the early twenties of the last century, the Anglo-Indian government commissioned Colonel Chesney to investigate the navigability of the River Euphrates in order to establish the shortest possible connection between the Mediterranean and the Persian Gulf, resp. India. After detailed preparations and a preliminary reconnaissance in winter 1831, the expedition proper set out in 1835/7. In due course, British staff and officials investigated and surveyed a wider area in Eastern Mesopotamia. These efforts dragged on until 1866 without any useful results for the British government. But at a later date Great Britain returned to the plan of connecting the Mediterranean with India by way of the Gulf of Persia, though in a different form, i.e. the Tigris railway project. In 1879, Cameron travelled through Mesopotamia for the British government to study the lay of the land for the projected railway (Max Freiherr v. Oppenheim, Vom Mittelmeer zum Persischen Golf durch den Hauran, die Syrische Wüste und Mesopotamien, vol.ii, pp.5 and 36)

(11) S. Schneider, Die Deutsche Bagdadbahn (1900), p.3.

(12) Saling, Börsenjahrbuch 1911/12, p.2211.

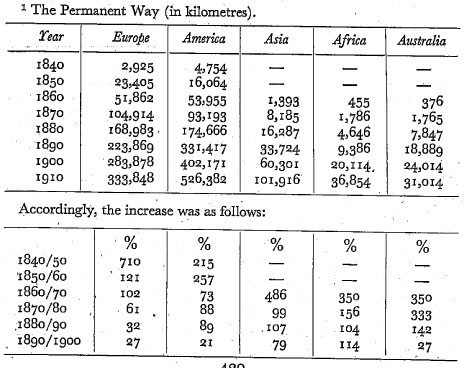

(13) Saling, op. cit., pp.360-1. Engineer Pressel of Württemberg, who as assistant to Baron v. Hirsch was actively engaged in these transactions in European Turkey, neatly accounts for the total grants towards railway building in Turkey which European capital wrested from the Turkish government:

|

All this refers only to the period before 1899; not until that date were the revenue grants paid in part. The tithes of no less than 28 out of the 74 sandshaks in Asiatic Turkey had been pledged for the revenue grants, and with these grants; between 1856 and 1900, a grand total of 1,516 miles of rails had been laid down in Asiatic Turkey. Pressel, the expert, by the way gives an instance of the underhand methods employed by the railway company at Turkish expense; he states that under the 1893 agreement the Anatolian company promised to run the railway, to Baghdad via Angora, but later decided that this plan of theirs would not work and, having qualified for the guarantee, left the line to its fate and got busy with another route via Konya.

‘No sooner have the companies succeeded in acquiring the Smyrna–Aydin–Diner line, than they will demand the extension of this line to Konya, and the moment these branch lines are completed, the companies will move heaven and earth to force the goods traffic to use these new routes for which there are no guarantees, and which, more important still, need never share their takings, whereas the other lines must pay part of their surplus to the government, once their gross revenue exceeds a certain amount. In consequence, the government will gain nothing by the Aydin fine, and the companies will make millions. The government will foot the bill for practically the entire revenue guarantee for the Kassaba–Angora line, and can never hope to profit by its contracted, 25 per cent share in the surplus above £600 gross takings’ (W.V. Pressel, Les Chemins de Fer en Turquie d’Asie (Zurich 1900), p.7).

(14) Charles Moravitz, Die Türkei im Spiegel ihrer Finanzen (1903), p.84.

(15) ‘Incidentally, in this country everything is difficult and complicated. If the government wishes to create a monopoly in cigarette paper or playing cards, France and Austro-Hungary immediately are on the spot to veto the project in the interest of their trade. If the issue is oil, Russia will raise objections, and even the Powers who are least concerned will make their agreement dependent on some other agreement. Turkey’s fate is that of Sancho Panza and his dinner: as soon as the minister of finance wishes to do anything, some diplomat gets up, interrupts him and throws a veto in his teeth’ (Moravitz, op. cit., p.70).

Last updated on: 12.12.2008