Law of the Accumulation and Breakdown,

Henryk Grossman 1929

2. The Law of Capitalist Breakdown

Is there a theory of breakdown in Marx?

Even if Marx did not actually leave us a concise

description of the law of breakdown in any specific passage

he did specify all the elements required for such a

description. It is possible to develop the law as a natural

consequence of the capitalist accumulation process on the

basis of the law of value, so much so that its lucidity

will dispose of the need for any further proofs.

Is it correct that the term ‘theory of

breakdown’ stems from Bernstein, not Marx? Is it true

that Marx nowhere ever spoke of a crisis that would sound

the death knell of capitalism, that ‘Marx uttered not

a single word that might be interpreted in this

sense’, that this ‘stupid idea’ was

smuggled into Marx by the revisionists? (Kautsky, 1908, p.

608) To be sure, Marx himself referred only to the

breakdown and not to the theory of breakdown, just as he

did not write about a theory of value or a theory of wages,

but only developed the laws of value and of wages. So if we

are entitled to speak of a Marxist theory of value or

theory of wages, we have as much right to speak of

Marx’s theory of breakdown.

In the section on the law of the tendency of the rate of

profit to fall in the course of accumulation where Marx

shows how the accumulation of capital proceeds not in

relation to the level of the rate of profit, but in

relation to its mass, he says, ‘This process would

soon bring about the collapse of capitalist production if

it were not for counteracting tendencies which have a

continuous decentralising effect alongside the centripetal

one’ (1959, p. 246). So Marx observes that the

centripetal forces of accumulation would bring about the

breakdown of capitalist production, were it not for the

simultaneous operation of counteracting tendencies.

However, the operation of these counteracting tendencies

does not do away with the action of the original tendency

towards breakdown: the latter does not cease to exist. So

Marx’s statement is only intended to explain why this

tendency towards breakdown does not enforce itself

‘soon’. To deny this is to distort the clear

sense of Marx’s words.

However it is scarcely a matter of words which

‘might be interpreted in this sense’, and so

on. Where the mere interpretation of words leads to is

quite obvious from the directions in which Kautsky drags

Marx’s theory. For us the question is: suppose

initially we abstract from the counteracting tendencies

that Marx speaks of, how and in what way can accumulation

bring about the breakdown of capitalist production? This is

the problem we have to solve.

Preliminary methodological remarks

We have to show how, as a result of causes which stem

from the economic process itself, the capitalist process of

reproduction necessarily takes the form of cyclical and

therefore periodically recurring movements of expansion and

decline and how finally it leads to the breakdown of the

capitalist system. However if the investigation is to be

fruitful and to lead to exact results, we shall have to

choose a method that can ensure this exactness.

What should we regard as the characteristic, determining

condition of the reproductive cycle? Lederer identifies

this as the price movements in the course of the business

cycle: in periods of expansion commodity prices, including

the price of labour power, rise; in periods of crisis and

depression they fall. Therefore his way of posing the

question is the following: how is a general increase of

prices possible in periods of expansion? Expansions in the

volume of production such as characterise periods of boom

are, according to Lederer, only possible due to price

increases. Therefore price increases are what he has to

explain first. Lederer sees the creation of additional

credit as the sole impulse behind price increases.

Consequently he attributes to this factor the major role in

determining the shape of the business cycle.

Spiethoff’s explanation is quite different:

‘An increase in capital investments forms the true

hallmark and causal factor of every boom’ (1925, p.

13). Here not one word is said about price increases and we

could just as well choose a whole series of other forces as

our basic indicators without moving one step further in

explaining the problem. For the question is not one of

which appearances are characteristic or typical of the

business cycle, but which are necessary to it in the sense

that they condition it. That price increases generally

occur during an upswing does not mean that they are

necessarily connected with it. If like Lederer, we were to

assume that upswings presuppose rising prices we would be

totally stumped by the American booms which were sometimes

characterised by falling prices. That a wrong

starting-point has been chosen is obvious. Both rising

prices and expanded outlays on production are in themselves

matters of indifference to the capitalist entrepreneur.

The capitalist process of production has a dual

character. It is a labour process for the production of

commodities, or products, and it is at the same time a

valorisation process for obtaining surplus value or

profits. Only the latter process forms the essential

driving force of capitalist production, whereas the

production of use values is for the entrepreneur only a

means to an end, a necessary evil. The entrepreneur will

only continue production and extend it further if it

enables him to enlarge his profits. Expanded outlays on

production, or accumulation, are only a function of

valorisation, of the magnitude of profits. If profits are

expanding production will be expanded, if valorisation

fails production will be cut. Furthermore, both situations

are compatible with constant, falling or rising prices.

Of these three possible price situations the assumption

of constant prices is the one most appropriate to theory,

in the sense that it is the simplest case and a starting

point from which the other two more complicated cases can

be examined later. The assumption of constant prices thus

forms a methodologically valid theoretical fiction with a

purely provisional character; it is, so to speak, a

coordinate system within economics, a stable reference

point that makes possible exact measurement of quantitative

variations in profitability in the course of production and

accumulation.

The basic question we have to clarify is how are profits

affected by the accumulation of capital and vice versa. Do

profits remain constant in the course of accumulation, do

they grow or do they decline? The problem boils down to an

exact determination of variations in surplus value in the

course of accumulation. In answering this question we also

clarify the cyclical movements or conjunctural oscillations

that define the process of accumulation.

These considerations underlie Marx’s analysis:

‘Since the production of exchange value — the

increase of exchange value — is the immediate aim of

capitalist production, it is important to know how to

measure it’ (1972, p. 34). In order to establish

whether an advanced capital value has grown during its

circuit or by how much it has grown in the course of

accumulation, we must compare the final magnitude with the

initial magnitude. This comparison, which forms the basis

of any rational capitalist calculation, is only possible

because — in the form of costs of production and

prices of the end product — value exists under

capitalism as an objectively ascertainable independent

magnitude. As something which is objectively ascertainable

on the market, value constitutes both the basis of

capitalist calculation and its form of appearance. Its

explanation is thus the starting-point of any theoretical

analysis.

From the very beginnings of free capitalism attempts

were made to grasp the independent character of value

— its aspect as an objective, external entity —

in numerical terms. H Sieveking tells us that ‘the

rational approach to economics was enormously speeded up by

the introduction of book-keeping’ (1921, p. 96). The

ability to calculate the yield on a sum of values

originally invested is a vital condition for the existence

of capital:

as value in motion, whether in the

sphere

of production or in either phase of the sphere of

circulation capital exists ideally only in the form of

money of account, primarily in the mind of the producer of

commodities, the capitalist producer of commodities. This

movement is fixed and controlled by book-keeping, which

includes the determination of prices, or the calculation of

the prices of commodities. The movement of production,

especially of the production of surplus value ... is thus

symbolically reflected in imagination. (Marx, 1956, p.

136)

Through prices the fluctuations of a given capital value

in the course of its circuit become expressed in money,

which serves as measure of value required for accounting.

And with respect to this measure of value Marx proceeds

from the assumption, which is purely fictitious and which

forms the basis of his analysis, that the value of money is

constant. At first sight this appears to be all the more

surprising in the sense that, in his polemic with

Ricardo’s ‘invariable measure of value’,

Marx emphasised that gold can only serve as a measure of

value because its own value is variable. In reality the

values of all commodities, including gold, are variable.

But science needs invariable measures: ‘the interest

in comparing the value of commodities in different

historical periods is, indeed, not an economic interest as

such, but an academic interest’ (Marx, 1972, p.

133).

From historical surveys of the development of

thermometry we know that a reliable measure of heat

variations was established through the fundamental work of

Amonton, with the discovery of two fundamental points

(boiling-point and the absolute null point of water) for

any liquid used as the measure of heat variations. This

alone could establish the constant reference points with

which it became possible to compare the variable states of

heat (Mach, 1900, p. 8).

There are no such constant reference points for gold as

the measure of value. So an exact measure of the value

fluctuations of commodities would be impossible. On the one

hand changes in the value of the money commodity may differ

from the changes in the value of individual commodity

types. In this case we have no exact measure to ascertain

how far, say, the rising prices of a given commodity have

been caused through changes in its own value and how far

through changes in the value of the money commodity. In

this case, suppose we were studying variations in the

magnitude of surplus value; then, with a variable value of

money, it would be difficult to tell whether a given

increment in value (or price) was not something merely

apparent and caused purely by changes in the value of

money:

In all these examples there would,

however, have been no actual change in the magnitude of

capital value, and only in the money expression of the same

value and the same surplus value ... there is, therefore,

but the appearance of a change in the magnitude of the

employed capital. (Marx, 1959, pp. 139-40)

Alternatively the value of money vanes in the same

proportion as the values of other commodities, for instance

due to general changes in productivity — a limiting

case that is scarcely possible in reality. In that case

there would have been enormous absolute changes in the real

relations of production and wealth, but these actual

changes would be invisible on the surface, because the

relative proportions of individual commodity values would

remain the same. The price index would not register the

actual changes in productivity.

Thus it was entirely valid for Marx to substitute the

‘power of abstraction’ for the missing constant

reference points, so falling into line with Galileo’s

principle: ‘measure whatever is measurable, and make

the non-measurable measurable’. For instance to

ascertain the impact of changes in productivity on the

formation of value and surplus value, Marx is forced to

introduce the assumption that the value of money is

constant. This assumption is therefore a methodological

postulate that equips Marx with an exact measure for

ascertaining variations in the value of industrial capital

during its circuit. It is an assumption underlying all

three volumes of Capital.

The variability of the measure of value, or of money, is

only one of the causes of price changes. Such changes can

just as well stem from causes that lie on the commodity

side of the exchange relation. Here we should distinguish

two cases. Either these variations of price are, from a

social point of view, consequences of actual changes in

value. (This is the case that preoccupies Marx initially,

and it is these changes he wants to measure.) Or these

variations of price represent deviations of prices from

values, which do not in any case affect the total social

mass of value because price increases in one sector of

society correspond to price reductions in another.

The specific task that Marx set himself of measuring as

exactly as possible increases in value over and above the

initial magnitude of the advanced capital, forced him to

exclude price changes of the latter sort. Price

fluctuations that represent deviations from value are the

result of changing configurations of supply and demand. Now

if one proceeds from the assumption that supply and demand

coincide then prices will coincide with values. Motivated

by specific methodological considerations, Marx starts off

his analysis with the assumption that supply and demand

coincide. He assumes a state of equilibrium with respect to

supply and demand, both on the commodity market and on the

labour market, in order to be able to cover the more

complicated cases later. Hence whenever production is

expanded it is presupposed that this occurs proportionally

in all the spheres so that the equilibrium is not

destroyed. The reverse case, where production expands

disproportionally, is taken up later.

Variations analysed at later stages are likewise exactly

measurable only due to the simplifying assumptions that

define this hypothesised state of equilibrium, which is not

only directly reflected in the reproduction schemes but

which forms the starting-point of the analysis as its

coordinate system. Marx’s Capital has a

mathematical-quantitative character. Only these

methodological devices allow an exact analysis of the

accumulation process.’[1]

Can accumulation proceed indefinitely without halts in

the process of reproduction? To say ‘yes’ and

to regard this as something self-evident without

undertaking an actual analysis is to misunderstand the

question completely. For instance professor Kroll argues

that if commodities were exchanged at equilibrium prices,

where supply equals demand, then there would be no

conjunctural oscillations. He supposes that any decline in

profitability is because wages are too high (Kroll, 1926,

p. 214). But why were they not too high previously? What

can ‘too high’ mean when we have no basis of

comparison in the form of a ‘normal case’ such

as represented by the reproduction scheme? If all the

elements are variable, then the influence of any individual

factor is impossible to assess. The causal relation that

Kroll observes between the level of wages and falling

profitability is not something we can presuppose; it has to

be demonstrated. Therefore a scientific analysis is in

principle bound to take as its starting point the case

where wages are held constant in the course of

accumulation, and it has to find out whether in such cases

profits do not fall in the course of accumulation. If they

do, then it would be a logically exact proof that falling

profitability, or crises, bear no causal connection with

the level of wages but are a function of the accumulation

of capital. The assumption of equilibrium, or of constant

prices, is nothing but the method of variation applied to

the problem of the business cycle in a form that excludes

from the analysis all oscillations produced by changes in

the volume of credit, prices, etc; it studies only the

impact of the accumulation of capital, on quantitative

changes in surplus value.

This is the assumption behind Marx’s analysis of

the crisis; ‘The general conditions of crises, in so

far as they are independent of price fluctuations ... must

be explicable from the general conditions of capitalist

production’ (1969, p. 515). According to Marx crises

can result from price fluctuations. But they were of no

concern to him. Marx takes as the object of his analysis

‘capital in general’; he is concerned only with

those crises that stem from the nature of capital as such,

from the essence of capitalist production. However this

essence is only penetrable when we abstract from

competition and thus confine ourselves to ‘the

examination of capital in general, in which prices of

commodities are assumed to be identical with the values of

the commodities’ (p. 515). This identity of price and

value is in turn only possible if the apparatus of

production is assumed to be in a state o~ equilibrium. Marx

makes an assumption of this sort. The same holds for

credit. Credit crises are possible and do occur. But the

question is, are crises necessarily connected with the.

movement of credit? Hence on methodological grounds we must

first exclude credit and then see whether crises are

possible. Marx says:

In investigating why the general

possibility of crisis turns into a real crisis, in

investigating the conditions of crisis, it is therefore

quite superfluous to concern oneself with the forms of

crisis which arise out of money as means of payment [credit

— HG]). This is precisely why economists like to

suggest that this obvious form is the cause of crises. (pp.

514-5)

Once we have shown that even in a state of equilibrium,

where prices and credit are ignored, crises are not only

possible but inherent, then we have proved that there is no

intrinsic connection between the movement of prices and

credit on the one hand and crises on the other; ‘that

is to say, crises are possible without credit’ (p.

514).

Bourgeois economists try to explain the movement of

market prices by competition or the changing relations of

supply and demand. But why does competition exist? This

question they do not pose. Competition becomes some

mysterious quality that one simply assumes or submits to

without exploring its causes. ‘Competition exists

only in industry’, Sternberg tells us, ‘because

the law of rising returns is fully valid for industry, or

individual entrepreneurs struggle to control the market by

cheapening their commodities’ (Sternberg, 1926, p.

2). But why should they struggle to control the market, why

should there not be outlets for the ‘rising

returns’ of industry? This is not something logically

necessary or obvious, and simply to assume it is to start

off by presupposing what has to be proved. With this

mystical force which has been left unexplained, he then

tries to explain all other phenomena.

Marx was perfectly right in saying that

‘competition has to shoulder the responsibility of

explaining all the meaningless ideas of the economists,

whereas it should be the economists who explain

competition’ (1959, p. 866). In fact:

a scientific analysis of competition is

not possible, before we have a conception of the inner

nature of capital, just as the apparent motions of the

heavenly bodies are not intelligible to any but him, who is

acquainted with their real motions, motions which are not

directly perceptible by the senses. (Marx, 1954, p.

300)

But how do we grasp the inner nature of capital?

Marx’s answer is, since individual capitalists

‘confront one another only as commodity owners, and

everyone seeks to sell his commodity as dearly as

possible... the inner law enforces itself only through

their competition, their mutual pressure upon each other,

whereby the deviations are mutually cancelled’ (1959,

p. 880). So in reality the inner law of capitalism enforces

itself through the mutual cancellation of deviations of

supply and demand, which only means that it is through this

process that the mechanism preserves its equilibrium.

The inner law only works itself out in reality through

the constant deviation of prices from values. But in order

to gain a theoretical perception of the law of value

itself, we have to assume it as already realised, that is,

we abstract from all deviations from the law. This does not

mean that competition is discarded; rather it is conceived

in its latent state, as a special case where its two

opposing forces are in equilibrium. Only this ‘normal

case’ draws out the various economic categories

— value, wages, profit, ground-rent, interest —

in their pure form, as independent categories. This is the

starting point of Marx’s analysis. He states:

let us assume that the component value

of

the commodity product, which is formed in every sphere of

production by the addition of a new quantity of labour ...

always splits into constant proportions of wages profit and

rent, so that the wage actually paid always directly

coincides with the value of labour-power, the profit

actually realised with the portion of the total surplus

value which falls to the share of each independently

functioning part of the total capital by virtue of the

average rate of profit, and the actual rent is always

limited by the bounds within which ground rent on this

basis is normally confined. In a word, let us assume that

the division of the socially produced values and the

regulation of the prices of production take place on a

capitalist basis, but with competition eliminated. (1959,

pp. 869—70)

Starting from this methodological basis is it possible

to ask - what is the impact of the accumulation of capital

on the process of reproduction? Can the equilibrium which

is presupposed be sustained in the long run or do new

moments emerge in the course of accumulation which have a

disruptive effect on it?

The equilibrium theory of the neo-harmonists

In approaching this problem I shall refrain from

constructing any scheme~ of my own and demonstrate the real

facts through Bauer’s reproduction scheme (see Table

2.1). In Chapter 1 we saw the neo-harmonists Hilferding,

Bauer and others join the company of Tugan-Baranovsky in

reproducing a version of JB Say’s old proportionality

theory in order to prove that capitalism contains unlimited

possibilities of development.

No doubt, as an answer to Luxemburg’s theory, the

reproduction scheme constructed by Bauer represents a

distinct progress over all earlier. attempts of this kind.

Bauer succeeded in constructing a reproduction scheme

which, apart from some mistakes, matches all the formal

requirements that one could impose on a schematic model of

this sort.[2]

Bauer’s scheme shows none of the defects that

Luxemburg ascribed t the reproduction scheme of Marx. First

it takes account of incessant technological advances and

incorporates this in the form of an ever-increasing organic

composition of capital. Consequently what Luxemburg calls

the ‘cornerstone of Marxist theory’ is

preserved. Second, it avoids Luxemburg’s criticism

that ‘there is no obvious rule in this accumulation

or consumption’, for Bauer’s scheme does

specify rules to which accumulation must correspond —

constant capital grows twice as fast as variable capital -

the former by ten per cent, the latter by five per cent per

annum. Third although capitalist consumption increases

absolutely, increases in productivity and the mass of

surplus value allow a progressively greater portion of the

surplus value to be earmarked for the purposes of

accumulation. Fourth, Bauer’s scheme preserves the

symmetry between Departments I and II required by

Luxemburg. In Marx’s scheme Department I always

accumulates half its surplus value, whereas accumulation in

Department II is anarchic and jerky. In Bauer’s

scheme both departments annually devote the same percentage

of surplus value to accumulation. Finally the rate of

profit behaves according to the Marxist law of its

tendential fall. No wonder Luxemburg herself preferred the

cautious warning:

Naturally I shall not let myself be drawn into a

discussion of Bauer’s tabulated calculations. His

position and his critique of my book depend mainly on the

theory of population which he counterposes to my ideas as

the basis of accumulation, and which in itself really has

nothing to do with any mathematical models. (1972, p.

90)

Table 2.1: Bauer’s reproduction scheme

|

|

Year

|

Dept

|

c

|

v

|

k

|

ac

|

av

|

AV

|

k/s

|

as+av/s

|

|

1

|

One

|

120,000 +

|

50,000 +

|

37,500 +

|

10,000 +

|

2,500 =

|

220,000

|

|

|

| |

Two

|

80,000 +

|

50,000 +

|

37,500 +

|

10,000 +

|

2,500 =

|

1800,000

|

|

|

| |

|

200000 +

|

100 000 +

|

75000 +

|

20000 +

|

5000 =

|

400 000

|

75.00%

|

25.00%

|

|

2

|

One

|

134 666 +

|

53667 +

|

39740 +

|

11 244 +

|

2683 =

|

242 000

|

|

|

| |

Two

|

85334 +

|

51 333 +

|

38010 +

|

10756 +

|

2567 =

|

188000

|

|

|

| |

|

220000 +

|

105000 +

|

77750 +

|

22000 +

|

5250 =

|

430000

|

74.05%

|

25.95%

|

|

3

|

One

|

151048 +

|

57567 +

|

42070 +

|

12638 +

|

2868 =

|

266200

|

|

|

| |

Two

|

90952 +

|

52674 +

|

38469 +

|

11562 +

|

2643 =

|

196300

|

|

|

| |

|

242 000 +

|

110250 +

|

80539 +

|

24200 +

|

5511 =

|

462 500

|

73.04%

|

26.96%

|

|

4

|

One

|

169124

|

61738

|

44465

|

14186

|

3087

|

292600

|

|

|

| |

Two

|

96876

|

54024

|

38909

|

12414

|

2701

|

204924

|

|

|

| |

|

266 000

|

115762

|

83374

|

26600

|

5788

|

497 524

|

72.02%

|

27.98%

|

|

(rate

of profit) (rate

of profit)

|

Key:

c= constant capital

v= variable capital

k= capitalist’s consumption (personal)

ac =

accumulated as constant capital

av =

accumulated as variable capital

AV= value of annual product

s= surplus value (= k +ac

+av)

|

| |

Year %

1. 33.3

2. 32.6

3. 31.3

4. 30.3

|

The critique that I shall make of Bauer’s scheme

starts from a quite different perspective from

Luxemburg’s (see Table 2.1). I shall show that

Bauer’s scheme reflects and can reflect only the

value side of the reproduction process. In this sense it

cannot describe the real process of accumulation in terms

of value and use value. Secondly Bauer’s mistake lies

in his supposing that the scheme is somehow an illustration

of the actual processes in capitalism, and in forgetting

the simplifications that go together with it. But these

shortcomings do not reduce the value of Bauer’s

scheme. As long as we examine the process of reproduction

initially from the value side alone.

The conditions and tasks of schematic analysis

In the following sections I propose to accept

Bauer’s assumptions completely. But the problem is

not simply to explain crises — the periodic

expansions and contractions of the business cycle under

capitalism — and their causes but also to find out

what are the general tendencies of development of the

accumulation of capital. Initially we make the favourable

assumption that accumulation proceeds on the basis of

dynamic equilibrium of the kind reflected in Bauer’s

scheme.

On this assumption Luxemburg’s criticism that

‘the question of markets does not even exist for

Bauer’ although periodic crises ‘obviously stem

from disproportions between production, that is the supply

of commodities, and market, that is demand for

commodities’ (1972, p. 121) becomes meaningless and

untenable. For Marx worked out the problem of accumulation

and the whole analysis of Capital Volume One on the

conscious assumption that commodities sell at value, which

is only possible when supply and demand coincide. Marx

studied the tendencies of accumulation in abstraction from

all disturbances arising out of disproportions between

supply and demand Such disturbances are phenomena of

competition that help us to explain deviations from the

‘trend line’ of capitalism, but not this trend

line itself.

For Marx these phenomena are the ‘illusory

appearances of competition’ and for that reason he

abstracts from the movement of competition when

investigating the general tendencies. Once these general

tendencies~ have been established it is an easy task to

explain the periodic deviation~ from the basic line of

development, or the periodic crises. In this sense the

Marxist theory of accumulation and breakdown is at the same

time. theory of crises.

With Bauer we shall assume a productive mechanism in

which constant capital amounts to 200 000 and variable

capital to 100 000. The other assumptions are that: 120 000

of this constant capital is apportioned to Department I

(means of production) and 80 000 to Department II (means of

consumption); that the variable capital is equally divided

between both spheres; that the constant capital expands by

10 per cent a year and the variable capital by 5 per cent;

that the rate of surplus value is 100 per cent and that in

any given year the rate of accumulation is equal in the two

departments.

Proceeding from these assumptions, Bauer has constructed

a reproduction scheme which in his view manifests perfect

equilibrium year after year despite annual accumulation of

capital and despite the fact that there are no

non-capitalist markets in which the surplus value might be

realised. With this scheme Bauer thinks he has established

‘a perfect basis for tackling the problem raised by

Luxemburg’ (1913, p. 838). He rejects her theory of

the crucial role of the non-capitalist countries in the

realisation of surplus value; surplus value can be realised

entirely within capitalism. As long as the expansion of

capital is proportional to the growth of population —

for the given levels of productivity — the capitalist

mechanism creates its own market. As for the question

whether the accumulation of capital encounters insuperable

limits, Bauer’s answer is no:

This condition of equilibrium between

accumulation and the growth of population can only be

maintained, however, if the rate of accumulation rises

sufficiently fast to enable the variable capital to expand

as rapidly as population despite the rising organic

composition of capital. (p. 869)

But can the rate of accumulation proceed so fast? Bauer

does not pose this decisive question even once. He simply

took the basic point at issue as something self-evident, as

if the speed with which the rate of accumulation rises

depended solely on the will of the capitalists. From his

position it followed that capitalism would be destroyed not

through any objective limits on the growth of accumulation

but by the political struggle of the working class. The

masses would be drawn to socialism only through

painstaking, day-to-day educational work. Socialism can

only be the product of their conscious will.

Tugan-Baranovsky showed some time back that a conception

of this sort means giving up the materialist conception of

history. If capitalism really could develop the productive

forces of society without hindrance, the discontent of the

working class would lack any psychological basis. He

pointed out that if we hope for the downfall of capitalism

purely in terms of the political struggle of the masses

trained in socialism, then ‘the centre of gravity of

the entire argument is shifted from economics to

consciousness’ (1904, p. 274). Rosa Luxemburg wrote

in similar terms some twelve years later:

If we assume, with the

‘experts’, the economic infinity of capitalist

accumulation, then the vital foundation on which socialism

rests will disappear. We then take refuge in the mist of

pre-Marxist systems and schools which attempted to deduce

socialism solely on the basis of the ‘injustice and

evils of today’s world and the revolutionary

determination of the working classes. (1972, p. 76)

Why was classical economy alarmed by the fall in the

rate of profit despite an expanding mass of profit?

In Bauer’s scheme the portion of surplus value

reserved for the individual consumption of the capitalists

(k) represents a continuously declining percentage of

surplus value. But it grows absolutely despite increasing

accumulation from year to year, thereby providing the

motive that drives capitalists to expand production. We

might imagine that Bauer’s harmonist conclusions are

confirmed by his table. The percentage fall in the rate of

profit is of no concern because the absolute mass of profit

can and does grow as long as the total capital expands more

rapidly than the rate of profit falls. As Marx states:

the same development of the social

productive power of labour expresses itself with the

progress of capitalist production on the one hand in a

tendency of the rate of profit to fall progressively and,

on the other, in a constant growth of the absolute mass of

the appropriated surplus value, or profit. (1959, p.

223)

And:

The number of labourers employed by

capital, hence the absolute mass of the labour set in

motion by it, and therefore the absolute mass of surplus

labour absorbed by it, the mass of the surplus value

produced by it, and therefore the absolute mass of the

profit produced by it, can consequently increase,

and increase progressively, in spite of the progressive

drop in the rate of profit. And this not only can

be

so. Aside from temporary fluctuations it must be

so,

on the basis of capitalist production. (1959, p. 218)

If this is so, however, the question arises — why

should the capitalist be so worried if the rate of profit

falls as long as the absolute mass of his profit grows? To

ensure this growth all he needs to do is to accumulate

industriously; accumulate at a rate that exceeds the fall

in the rate of profit. Moreover why was classical economy

dominated by a deep sense of disquiet, of real

‘terror’ before the falling rate of profit? Why

is it a veritable ‘day of judgement’ for the

bourgeoisie (Marx, 1969, p. 544), why were Ricardo’s

followers in ‘dread of this pernicious

tendency’ (p. 541), why does Marx say that ‘his

law is of great importance to capitalist production’

(1959, p. 213), why does he say that the law of the falling

rate of profit ‘hangs ominously over bourgeois

production’ (1969, p. 541) when, in contrast, vulgar

economists ‘pointed self-consolingly to the

increasing mass of profit’ (Marx 1959, p. 223)? The

existing Marxist literature has no answer to any of these

questions.

In other words is the falling rate of profit a real

threat to capitalism? Bauer’s scheme appears to show

the opposite. By the end of year four both the fund for

accumulation and the fund for capitalist consumption have

grown absolutely. And yet, precisely with Bauer’s

scheme it will be shown that there are economic limits on

accumulation, that Bauer’s harmonist conclusions

about the possibilities of unlimited development represent

a banal delusion.

The views of classical economists on the future of

capitalism (D Ricardo and J S Mill)

Marx’s theory represented only the final stage of

a fairly long development. It was directly linked to the

theory of the classical economists and absorbed specific

elements from the latter in a modified and deepened form.

Ricardo had already reached the conclusion that due to the

rising costs of basic means of subsistence the

‘natural tendency of profits then is to fall’

(1984, p. 71). Because profit is the motive behind capital

the:

motive for accumulation will diminish

with every diminution of profit, and will cease altogether

when their [the capitalists] profits are so low as not to

afford them an adequate compensation for their trouble and

the risk they must necessarily encounter in employing their

capital productively. (p. 73)

Ricardo viewed the distant future of capitalism with a

sense of apprehension, stating that ‘if our progress

should become more slow; if we should attain the stationary

state, from which I trust we are yet far distant, then will

the pernicious nature of these laws become more manifest

and alarming’ (p. 63).

The roots of Ricardo’s theory of breakdown are

discernible in the imperfect valorisation of capital that

defines advanced stages of accumulation. The actual

phenomenon, the tendency for the rate of profit to fall,

was correctly perceived by Ricardo but he explained it in

terms of a natural process rooted in the declining

productivity of agriculture. Marx had only to replace this

natural basis with a social one intrinsic to the specific

nature of capitalism.

The theory of breakdown acquired a more developed form

in the work of J S Mill despite the several distortions

produced by his false theories of wages (the wage fund

theory) and ground rent, his erroneous views on the

relation of fixed capital to the level of the rate of

profit, and by his general lack of clarity about the

decisively important role of profit for the existence of

capitalism. Mill viewed the ‘stationary state’

as the general direction of the advance of modem society

but, unlike Ricardo, he contemplated the tendency with a

sense of equanimity: ‘I cannot regard the stationary

state of capital and wealth with the unaffected aversion so

generally manifested towards it by political economists of

the old school’ (Mill, 1970, p. 113). His standpoint

was one of a petty-bourgeois reformism that sought to

appease capital with the idea that a stationary state of

capital would in no sense jeopardise the general progress

of ‘human improvements’. In his utopianism Mill

seems to have forgotten that the accumulation of capital is

an essential condition of capitalist production, that the

capitalists have not the least interest in human

improvements; they are interested only in the level of

profitability. In this respect Ricardo and his school

showed a more correct understanding of the vital conditions

of capitalism than Mill himself.

However if we ignore these obviously essential points we

have to concede that Mill showed a far clearer insight into

the breakdown tendency and its causes, as well as into many

of its counteracting moments. Mill’s central argument

is that if capital continued to accumulate at its existing

rate and no circumstances intervened to raise its profits,

only a short time would be needed for the latter to fall to

the minimum. The expansion of capital would then soon reach

its ultimate limit (pp. 94—7). A general overstocking

of the market would occur. To Mill the basic difficulty was

not the lack of markets but the lack of investing

opportunities.

Counteracting circumstances can to some extent displace

or postpone this ultimate limit. Among such circumstances

Mill lists: 1) worsening conditions for workers, 2)

devaluation or destruction of capital, 3) improvements in

technology, 4) foreign trade that procures cheaper supplies

of raw materials and means of subsistence, 5) export of

capital to the colonies or to foreign countries. We shall

go into these circumstances in more detail later.

A comparison between the sections in Capital Volume

Three on the tendency of the rate of profit to fall and the

theory of breakdown developed by Mill shows that Marx

linked up his own theory to the one proposed by Mill. Even

if Marx gave it a much deeper foundation and made it

consistent with his law of value, Mill’s seminal role

is indisputable. In its external structure it shows the

same logical construction one finds in Ricardo and in Marx.

Marx also tackles the problem in two stages - first the

tendency towards breakdown, then the counteracting

tendencies — and refers to the fact that the process

of capital accumulation ‘would soon bring about the

collapse of capitalist production if it were not for

counteracting tendencies, which have a continuous

decentralising effect alongside the centripetal one’

(1959, p. 246). Marx mentions all the counteracting

tendencies adduced by Mill, even if he adds some others and

to some extent ascribes a different theoretical meaning to

them.

The Marxist theory of accumulation and breakdown

If we are going to discuss the tendencies of development

of a system, in this case — along with Bauer —

the tendency of accumulation to adjust to the growth of

population, then it is not enough simply to look at one or

two years. We have to view the development of the system

over a much longer span of time. Bauer did not do this. He

restricted his calculations to just four cycles of

production. This is the source of his mistakes.[3]The problem is

precisely whether

accumulation under the conditions postulated by Bauer is

possible in the long run. If Bauer had followed through

the development of his system over a sufficiently long

time-span he would have found, soon enough, that his

system necessarily breaks down.

If we follow Bauer’s system into year 36, holding

firm to all the conditions postulated by him, we see that

the portion of surplus value reserved for capitalist

consumption (k) which amounts to 86213 in the fifth

year and grows over the following years, can only expand up

to a definite high-point. After this it must necessarily

decline because it is swallowed up by the portion of

surplus value required for capitalisation.

The failure of valorisation due to

overaccumulation

Despite the fall in the rate of profit accumulation

proceeds at an accelerated tempo because the scope of

accumulation expands not in proportion to the level of

profitability, but in proportion to the weight of the

already accumulated capital: ‘beyond certain limits a

large capital with a small rate of profit accumulates

faster than a small capital with a large rate of

profit’ (Marx, 1959, pp. 250-l).[4]

Table 2.2: Bauer’s reproduction

scheme continued

|

|

Year

|

c

|

v

|

k

|

ac

|

a

|

AV

|

k/s

|

a/s

|

|

5

|

292600 +

|

121500 +

|

86213 +

|

29260 +

|

6077 =

|

535700

|

70.9%

|

29.1%

|

|

6

|

321860 +

|

127627 +

|

89060+

|

32186 +

|

6381 =

|

577114

|

69.7%

|

30.3%

|

|

7

|

354046 +

|

134008 +

|

91904+

|

35404 +

|

6700 =

|

622062

|

68.6%

|

31.4%

|

|

8

|

389450 +

|

140708 +

|

94728+

|

38945 +

|

7035 =

|

670866

|

67.35%

|

32.7%

|

|

9

|

428395 +

|

147743 +

|

97517+

|

42839 +

|

7387 =

|

723881

|

66.0%

|

34.0%

|

|

10

|

471234 +

|

155130 +

|

100251+

|

47123 +

|

7756 =

|

781494

|

64.63%

|

35.37

|

| |

|

|

|

|

|

|

|

|

|

20

|

1222252 +

|

252961 +

|

117832+

|

122225 +

|

12634 =

|

1727634

|

46.6%

|

53.4%

|

|

21

|

1344477 +

|

265325 +

|

117612+

|

134447 +

|

13266 =

|

1875127

|

44.3%

|

55.7%

|

| |

|

|

|

|

|

|

|

|

|

25

|

1968446 +

|

322503 +

|

109534+

|

196844 +

|

16125 =

|

2613452

|

33.9%

|

66.1%

|

| |

|

|

|

|

|

|

|

|

|

34

|

4641489 +

|

500304 +

|

11141+

|

464148 +

|

25015 =

|

5642097

|

0.45%

|

99.55%

|

|

35

|

5105637 +

|

525319 +

|

0

|

510563 +

|

l4756*=

|

6156275

|

0

|

104.61%(!)

|

|

36a

|

Capital

available: 5616200

|

Population available: 551584

|

|

Required:26265,

Deficient: 11509

|

|

|

|

|

36b

|

Capital in operation:

|

Active population:

|

|

|

|

|

|

|

| |

5499015

|

540075

|

0

|

540075

|

0

|

6696350

|

0

|

109.35%(!)

|

|

36c

|

Surplus capital:

|

Reserve army:

|

|

Required: 5616200

|

Required: 27003

|

|

|

|

| |

117185

|

11509

|

|

Deficit: 21545

|

Deficit: 27003

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(rate

of profit) (rate

of profit)

|

|

| |

Year

%

5

29.3

6

28.4

7

27.4

8

26.5

34

9.7

35

9.3

36

8.7

|

|

|

|

We can see that after ten years the original capital

expands from a value of 300 000 to 681 243, or by 227 per

cent, despite a continuous fall in the rate of profit. In

the second decade the rate of expansion of capital amounts

to 236 per cent, although the rate of profit falls even

further from 24.7 per cent to 16.4 per cent. Finally in the

third decade the accumulation of capital proceeds still

faster, with a decennial increase of 243 per cent, when the

rate of profit is even lower. So Bauer’s scheme is a

case of a declining rate of profit coupled with accelerated

accumulation. The constant capital grows rapidly, it rises

from 50 per cent of the total product in the first year to

82.9 per cent of the annual product by year 35. Capitalist

consumption (k) reaches a peak in year 20 and from

the following year on declines both relatively and

absolutely. In year 34 it reaches its lowest level only to

disappear completely in year 35.

It follows that the system must break down. The

capitalist class has nothing left for its own personal

consumption because all existing means of subsistence have

to be devoted to accumulation. In spite of this there is

still a deficit of 11 509 on the accumulated variable

capital (av) required to

reproduce the

system for a further year. In year 35 Department Two

produces consumer goods to a total value of 540 075

whereas, on Bauer’s assumption of a 5 per

cent

increase in population, 551 584 of variable capital is

required.

Bauer’s assumptions cannot be sustained any

further, the system breaks down. From year 35 on any

further accumulation of capital under the conditions

postulated would be quite meaningless. The capitalist would

be wasting effort over the management of a productive

system whose fruits are entirely absorbed by the share of

workers.

If this state persisted it would mean a destruction of

the capitalist mechanism, its economic end. For the class

of entrepreneurs, accumulation would not only be

meaningless, it would be objectively impossible because the

overaccumulated capital would lie idle, would not be able

to function, would fail to yield any profits: ‘there

would be a steep and sudden fall in the general rate of

profit’ (Marx, 1959, p. 251).

This fall in the rate of profit at the stage of

overaccumulation is different from the fall at early stages

of the accumulation of capital. A falling rate of profit is

a permanent symptom of the progress of accumulation through

all its stages, but at the initial stages of accumulation

it goes together with an expanding mass of profits and

expanded capitalist consumption. Beyond certain limits

however, the failing rate of profit is accompanied by a

fall in the surplus value earmarked for capitalist

consumption (in our scheme this appears in year 21) and

soon afterwards of the portions of surplus value destined

for accumulation. ‘The fall in the rate of profit

would then be accompanied by an absolute decrease in the

mass of profit ... And the reduced mass of profit would

have to be calculated on an increased total capital’

(Marx, 1959, p. 252).

This Marxist theory of the economic cycle which sees the

growing valorisation of social capital as the determining

cause of accumulation — of the upswing — and

its imperfect valorisation as the cause of the downturn

into crisis has been fully confirmed by recent empirical

studies. W C Mitchell (1927) has shown for the United

States, J Lescure (1910) for France, and Stamp (1918) for

Great Britain, that in periods of boom profits show an

uninterrupted rise, whereas in periods of crisis the level

of profitability declines. However, the agreement is at a

purely factual level. Lescure supposes that reductions in

profitability are due to shifts in commodity prices and

prime costs. He overlooks the fact that profitability

depends on the magnitude of capital, that is, on the

relationship between the rate of increase of profits and

that of capital. Overaccumulation is possible, and at a

specific stage of accumulation inevitable, even for a given

level of commodity prices and a given level of prime costs.

Further expansion of production can become unprofitable

even if the level of profits remains the same, indeed even

if it rises. To understand these complicated relationships

it is not enough simply to observe the movement of prices.

A more sophisticated method is required, and here the

assumption of constant prices for all elements of cost is

crucial to the exactness of the investigation. Variations

in costs (means of production, wages, interest) only

encourage or constrain phases of boom or stagnation, they

do not actually produce these phases themselves.

The formation of the reserve army of labour and of idle

capital due to overaccumulation

Imperfect valorisation due to overaccumulation is,

however, only one side of the accumulation process; we have

to look at its second side. Imperfect valorisation due to

overaccumulation means that capital grows faster than the

surplus value extortable from the given population, or that

the working population is too small in relation to the

swollen capital. But soon overaccumulation leads to the

opposite tendency.

Towards the closing stages of the business cycle the

mass of profits (s), and therefore also its

accumulated constant (ac)

and variable

(av) portions, contract so

sharply that

the additional capital is no longer sufficient to keep

accumulation going on the previous basis. It is therefore

no longer sufficient to enable the process of accumulation

to absorb the annual increase in population. Thus in year

35 the rate of accumulation requires a level of 510 563

ac + 26 265 av

= 536

828. But the available mass of surplus value totals only

525 319. The rate of accumulation required to sustain the

scheme is 104.6 per cent of the available surplus value; a

logical contradiction and impossible in reality.

From this point onwards valorisation no longer suffices

to enable accumulation to proceed in step with the growth

of population. Accumulation has become too small, which

means that a reserve army is inevitably formed and grows

larger year by year. Given our analysis of the reproduction

process in terms of a schematic model whose presupposition

is dynamic equilibrium, there can, by definition, be no

surplus population or reserve army of labour. The latter

emerges only at an advanced stage of accumulation and as

its product The assumption which is made initially can no

longer be sustained and is violated. The extension of

Bauer’s scheme shows that in year 35 there are 11 509

unemployed workers who form a reserve army.

In addition, because only a part of the working

population now enters the process of production, only a

part of the additional constant capital (510 563

ac) is required for buying

means of

production. The active population of 540 075 requires a

total constant capital of 5499015; the result is that 117

185 represents a surplus capital with no investment

possibilities.

The scheme is a lucid exposition of the condition Marx

had in mind when he called the corresponding section of

Capital Volume Three ‘Excess Capital and

Excess Population’ (pp. 250—9).

Overaccumulation, or imperfect valorisation, ensues because

the population base is too small. And yet there is

overpopulation, a reserve army. We cannot speak of a

logical contradiction here. ‘The so-called plethora

of capital’, Marx writes:

always applies essentially to a plethora

of capital for which the fall in the rate of profit is not

compensated through the mass of profit ... This plethora of

capital arises from the same causes as those which call

forth relative overpopulation, and is, therefore, a

phenomenon supplementing the latter, although they stand at

opposite poles — unemployed capital at one pole, and

unemployed worker population at the other. (1959, p.

251)

And a few pages later:

It is no contradiction that this

overproduction of capital is accompanied by more or less

considerable relative overpopulation. The circumstances

which increased the productiveness of labour, augmented the

mass of produced commodities, expanded markets, accelerated

accumulation of capital both in terms of its mass and its

value, and lowered the rate of profit — these same

circumstances have also created, and continuously create, a

relative overpopulation, an overpopulation of labourers not

employed by the surplus capital owing to the low degree of

exploitation at which alone they could be employed, or at

least owing to the low rate of profit they would yield at

the given degree of exploitation. (p. 256)[5]

A classic illustration is the United States today (March

1928) where, together with a superfluity of capital,

shortage of investment opportunities and massive

speculation in real estate and shares, there is a surplus

working population of 4 million unemployed workers. This

not because too much surplus value has been produced but

because in relation to the accumulated mass of capital too

little surplus value is available.

The fact that the means of production, and the

productiveness of labour, increase more rapidly than the

productive population, expresses itself, therefore,

capitalistically in the inverse form that the labouring

population always increases more rapidly than the

conditions under which capital can employ this increase for

its own self-expansion (Marx, 1954, p. 604).

We must be careful to distinguish the formation of the

reserve army due to a crisis of valorisation from the

‘setting free’ of workers through machinery.

The displacement of workers by machinery, which Marx

describes in the empirical part of Capital Volume

One (Chapter 15, ‘Machinery and Modem

Industry’), is a technical fact produced by the

growth of M relative to L and

as such is not

a specifically capitalist phenomenon. All technological

advance rests on the fact that labour becomes more

productive, that it is economised — or set free

— in relation to a given product. That machinery sets

free labour is an incontrovertible fact that needs no

proof; it belongs to the very concept of machinery as a

labour saving means of production. This process of the

setting free of workers will occur in any mode of

production, including the planned economy of socialism.

From this it follows that Marx could not possibly have

deduced the breakdown of capitalism from this technical

fact. In Chapter 25 of Capital Volume One, where

Marx derives the general law of capitalist accumulation,

the setting free of the worker through the introduction of

machinery is not mentioned. Here what Marx emphasises are

not the changes in the technical composition of capital

(ML) but changes in the organic composition of

capital (c:v): ‘The most important factor

in

this inquiry is the composition of capital and the changes

it undergoes in the course of the process of

accumulation’ (Marx, 1954, p. 574). Marx adds that:

‘Wherever I refer to the composition of capital,

without further qualification, its organic composition is

always understood’ (p. 574).

The technical composition forms only one aspect of the

organic composition; the latter is something more. It is

the value composition of capital as it is determined by,

and reflects, changes in the technical composition.

Consequently Marx converts the technical side of the labour

process, the relation M:L, into a value relation,

c.v. Under capitalism, the means of production

M and L figure as components of

capital, as

values, and they have to be valorised, that is, yield a

profit.

The valorisation process, and not the technical process

of production, is the characteristic driving force of

capitalism. Wherever valorisation falters the production

process is interrupted, even if from the standpoint of the

satisfaction of needs production as a technical process may

be desirable and necessary. The existing literature has

totally ignored the fact that the process of setting free

labour that Marx describes in the chapter on accumulation,

and which is reflected in the formation of the reserve

army, is not rooted in the technical fact of the

introduction of machinery, but in the imperfect

valorisation of capital specific to advanced stages of

accumulation. It is a cause that flows strictly from the

specifically capitalist form of production. Workers are

made redundant not because they are displaced by machinery,

but because, at a specific level of the accumulation of

capital, profits become too small and consequently it does

not pay to purchase new machinery and soon. Profits are

insufficient to cover these purchases anyway.

The portion of surplus value destined for accumulation

as additional constant capital (ac)

increases so rapidly that it devours a progressively larger

share of surplus value. It devours the portion reserved for

capitalist consumption (k), swallows up a large

part

of the portion reserved for additional variable capital

(av) and is still not

sufficient to

continue the expansion of constant capital at the

postulated rate of 10 per cent a year. In year 1 the

accumulated constant capital (ac)

amounts

to 20 per cent of the disposable surplus value of 100 000.

By year 35 it climbs to 510 563, or to over 97 per cent of

the disposable surplus value. Full employment requires a

residue of surplus value amounting to 26 265. But only 14

756 survives as a residue to cover wages. For the

capitalists’ consumption nothing remains. The

disposable mass of surplus value does not suffice to secure

the valorisation of the swollen capital. Because 11 509

workers remain unemployed in the following year, the

expanded capital now operates on a reduced valorisation

base.

Long before this final point is reached, already from

year 21 onwards when capitalist consumption begins to

decline absolutely, accumulation will have lost all meaning

for the capitalist. Each further advance in accumulation

means a further absolute reduction in capitalist

consumption. The vital importance of capitalist consumption

to the continued existence of capitalism is evident only at

this point. For accumulation to occur, surplus value must

be deployable in a threefold direction and must be divided

into three corresponding fractions:

i)

additional constant capital (ac)

ii)

additional

variable capital (av) or

additional means

of subsistence for workers

iii)

a consumption

fund for the capitalists (k)

Each of these three fractions is equally essential to

the further expansion of production on a capitalist basis.

If the available surplus value could cover only the first

two, accumulation would be impossible. For the question

necessarily arises — why do capitalists accumulate?

To provide additional employment to workers? From the point

of view of capitalists that would make no sense once they

themselves get nothing out of employing more workers.

From the point of view of the distribution of income,

such a mode of production would end up losing its private

capitalist character. Once the k portion of surplus

value vanishes, surplus value in the specific sense of an

income obtained without labour would have disappeared. The

other two fractions of surplus value, the additional

constant capital (ac) and

the additional

variable capital (av),

retain their

character of surplus value only so long as they are means

for the production of the consumption fund of the

capitalist class. Once this portion disappears, not an atom

of unpaid labour falls to the share of the capitalists. For

the entire variable capital falls to the share of the

working class, once the means of production have been

replaced out of it. Surplus value in the sense of unpaid

labour, of surplus labour over and above the time required

to produce essential means of subsistence, would have

vanished. All means of consumption would now form necessary

means of consumption. So it follows that the k

portion is an essential characteristic condition of the

accumulation of capital.

The vacuous and scholastic manner in which Luxemburg

argues is apparent now. Contemptuously she dismisses this

element from her analysis:

And yet, the growing consumption of the

capitalists can certainly not be regarded as the ultimate

purpose of accumulation; on the contrary, there is no

accumulation in as much as this consumption takes place and

increases; the personal consumption of the capitalists must

be regarded as simple reproduction. (1968, p. 334)

Luxemburg does not bother to explain how under simple

reproduction the consumption of the capitalists can

actually grow in the long run. Regarding the purpose of

accumulation Marx tells us that the aim of the entire

process ‘does not by any means exclude increasing

consumption on the part of the capitalist as his surplus

value ... increases; on the contrary, it emphatically

includes it’ (1956, p. 70). But to Luxemburg

accumulation only seems to make sense if the consumption of

capitalist commodities is left to the non-capitalist

countries. This belongs completely in the tradition of

mercantilism:

we find that certain exponents of the

mercantile system ... deliver lengthy sermons to the effect

that the individual capitalist should consume only as much

as the labourer, that the nation of capitalists should

leave the consumption of their own commodities, and the

consumption process in general, to the other, less

intelligent nations. (Marx, 1956, p. 60)

Obviously Marx had anticipated the whole of

Luxemburg’s theory.

We should not suppose, however, that the capitalist

simply waits passively until the entire k portion

has been swallowed up. Long before any such time (at latest

from in the scheme when the k portion begins to

decline absolutely) he will do his utmost to halt the

tendency. In order to do this he must either cut the wages

of the working class or cease to observe the conditions

postulated for accumulation, that is, the condition that

constant capital must expand by 10 per cent annually to

absorb the annual increase in the working population at the

given technological level. This would mean that from now on

accumulation would proceed at a slower rate, say 9.5 or 8

per cent. The tempo of accumulation would have to be slowed

down, and that, too, permanently and to an increasing

degree. In that case accumulation would fail to keep step

with the growth of the population. Fewer machines and so on

would be required or installed, and this only means that

the productive forces would be constrained from

developing.

It also follows that from this point in time on a

growing reserve army would necessarily form. The slowing

down of accumulation and the formation of the industrial

reserve army must necessarily follow even if wages are

assumed to be constant throughout this period. At any rate,

it would not be the result of an increase in wages, as

Bauer supposes.

Marx’s theory of breakdown is also a theory of

crises

The Marxist theory of accumulation described here

comprises not only a theory of breakdown but also a theory

of crises. Previous writings on Marx could not come to

terms with the essence of his theory due to their lack of

understanding of the method that underlies Marx’s

analysis and the structure of his magnum opus. The

objection has repeatedly been made that, despite its

crucial role in his system, Marx nowhere ever produced a

comprehensive description of his theory of crisis, that he

made scattered conflicting attempts at an explanation in

various passages of the book. This objection rests on a

crude misunderstanding. The object of Marx’s analysis

is not crisis, but the capitalist process of reproduction

in its totality. Given his method of investigation Marx

examines the unending circuit of capital and its functions

through all the phases of the process of reproduction.

Expressed in a formula this would mean:

Circuit one:

Circuit two:  etc

etc

Analysing each of the phases of capital in its circuit

as money capital, productive capital and commodity capital,

Marx asks: what impact do they have on the process of

production, can this process advance smoothly, or does the

normal course of reproduction encounter disruptions in its

various phases? If so what sort of obstacles, and what are

the factors that hinder the reproduction process in a given

phase?

One consequence of this method of investigation is that

Marx is compelled to return to the problem of crises at

various places in his work, in order to assess the specific

impact of each of the individual factors that come into

play in the different phases of the circuit. A systematic

description of the role of all these factors will have to

be reserved for my major study. Given the specific object

of this investigation I shall examine the impact of one

factor alone, even if it is the decisively important one -

the accumulation of capital from the standpoint of crises.

I shall be looking at the effects of the fact that a given

capital which began its first circuit as M (money

capital), opens up its second circuit as M’

(expanded money capital).

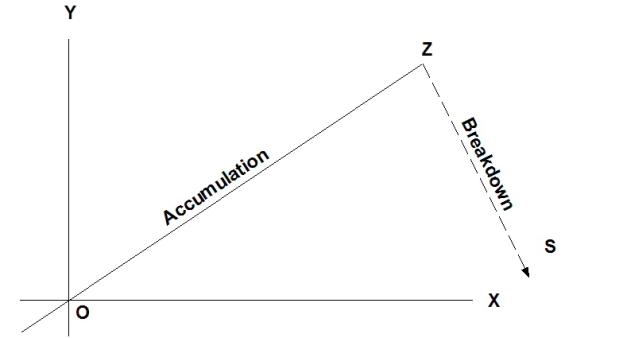

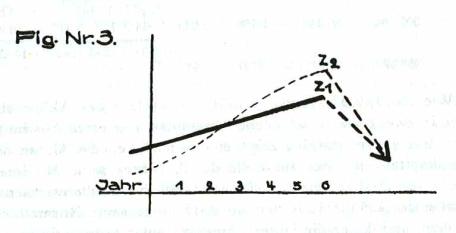

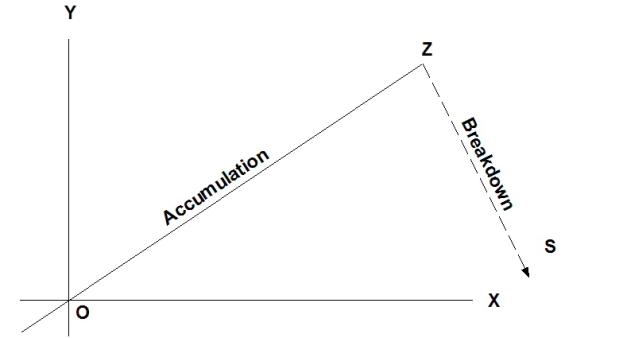

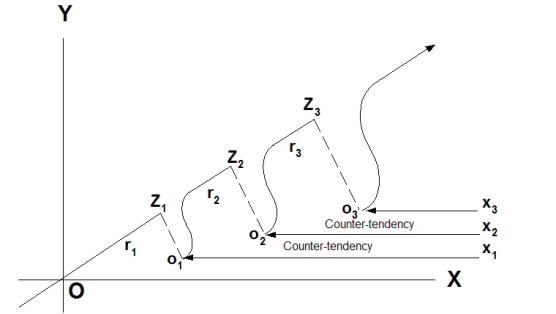

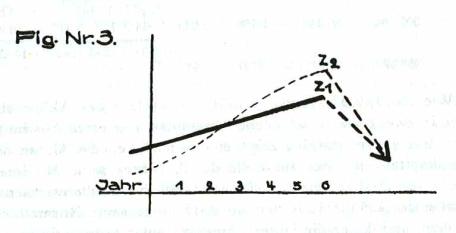

Figure 1

I have shown that as long as no counteracting or

modifying tendencies intervene, the effects are such that

from certain exactly determinable level of capital

accumulation they have to lead to a breakdown of the

system. In the coordinate system OX and OY

(Figure 1), if the line OX represents a condition

of

‘normal valorisation’ and OZ

the line of

accumulation in accordance with this equilibrium condition,

then the crisis of valorisation can be expressed as a

deviation of the line of accumulation in the direction ZS.

This would be the tendency towards breakdown, the basic

tendency of the system or its ‘trend’.

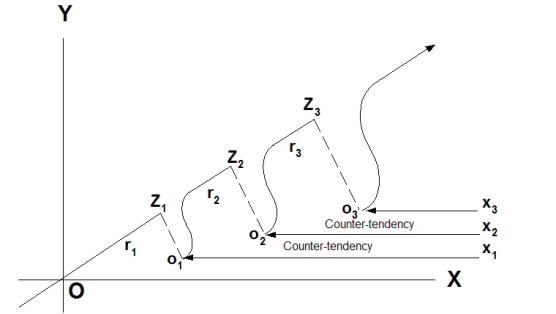

Figure 2

Let us suppose that in our coordinate system the

breakdown sets in at point z1(Figure

2)

and manifests itself in the form of an enormous devaluation

of capital whose overaccumulation starts at

r1(this is represented

graphically by the

punctuated line z1

—

o1).

In that case the

overaccumulated capital will be reduced back to the

magnitude required for its normal valorisation, and the

system will be brought back to a new state of equilibrium

at the higher level o1

—

z1.

We know that in Marx’s conception crises are

simply a healing process of the system, a form in which

equilibrium is again re-established, even if forcibly and

with huge losses. From the standpoint of capital every

crisis is a ‘crisis of purification’. Soon the

accumulation process picks up again, on an expanded basis,

and within certain limits (for instance,

o1—r2)

it

can proceed without any disruption of equilibrium. But

‘beyond certain limits’, from point

r2on, the accumulated capital

again grows

too large. The mass of surplus value starts to decline,

valorisation begins to slacken until finally, at point

z2, it evaporates completely

in the way

described earlier. The breakdown sets in again and is

followed by devaluation of capital,

z2—o2,

and

so on.

If we can show that due to various counteracting

tendencies the unfettered operation of the breakdown

tendency is repeatedly constrained and interrupted (at

points z1, z2,

z3 ... ) then the breakdown

tendency will

not work itself out completely and is, therefore, no longer

describable in terms of an uninterrupted straight line

ZS. Instead it will break up into a series of

fragmented lines (O

—z1—o1,

o1—z2—o2,

o2—z3—o3...)

all tending to the same final point. In this way the

breakdown tendency, as the fundamental tendency of

capitalism, splits up into a series of apparently

independent cycles which are only the form of its constant,

periodic reassertion. Marx’s theory of breakdown is

thus the necessary basis and presupposition of his theory

of crisis, because according to Marx crises are only the

form in which the breakdown tendency is temporarily

interrupted and restrained from realising itself

completely. In this sense every crisis is a passing

deviation from the trend of capitalism.

Despite the periodic interruptions that repeatedly

defuse the tendency towards breakdown, the mechanism as a

whole tends relentlessly towards its final end with the

general process of accumulation. As the accumulation of

capital grows absolutely, the valorisation of this expanded

capital becomes progressively more difficult. Once these

countertendencies are themselves defused or simply cease to

operate, the breakdown tendency gains the upper hand and

asserts, itself in the absolute form as the final

crisis.[6]

An anti-critical interlude

The passing of booms and the turn to depression is

frequently explained in terms of a series of factors that

push costs of production up, reduce profitability and

dampen business activity. This is the view of G Cassel who

gets stuck at the surface level and cannot grasp the deeper