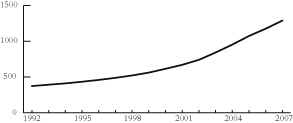

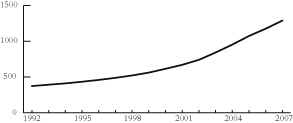

Figure 2: Total UK personal debt

(£ billions) (Source: Bank of England)

From International Socialism (2nd series), No.115, Summer 2007.

Copyright © International Socialism.

Downloaded with thanks from the International Socialism Website.

Marked up by Einde O’Callaghan for the Marxists’ Internet Archive.

As Tony Blair departed and Gordon Brown prepared to take over as prime minister one great myth was boomed out by New Labour’s propaganda machine – that Brown had achieved a “miracle” for the British economy. He achieved no less than the “longest period of sustained economic growth for more than 200 years ... the longest period of sustained growth since the beginning of the industrial revolution”. [1] It was a myth that most mainstream commentators avoided puncturing, eager as they are to see the major continental economies follow in Britain footsteps and embracing measures of “labour market flexibility”, “market testing”, privatisation and “contracting out” in the public sector, and longer working hours.

Yet the claim itself is simply false.

The years 1948 to 1973 witnessed continual economic growth. The period was characterised by a “stop-go” pattern –, but there was positive growth even in the “stop” phases. And the growth was faster than under New Labour. From 1949 to 1973, the UK economy grew at average rate of 3 percent per annum. It is true that growth averaged 3.2 percent a year in the first three years of New Labour, but after that it fell to an average of 2.4 percent a year for 2001 to 2006. [2]

The recent growth has not been sufficient to cover national expenditure. This is shown by what has happened to Britain’s trade figures. In March the UK imported £7 billion more in goods than it exported –, a trade deficit of more than 6 percent of GDP. Under the conditions of modern capitalism a national economy can continue to operate on that basis for a time (particularly, as with the British economy, if it has higher interest rates than most of its competitors and attracts foreign money eager to benefit from these). But such luck cannot continue indefinitely.

In some ways more significant than total growth rates are those per hour worked. These give some indication of the possibilities that are open to people to enjoy better lives –, although whether they do depends on what the growth consists of and how it is divided between classes. The rate of GNP growth per hour worked was lower from 1995 to 2004 than during the previous 45 years (figure 1).

|

Figure 1: Annual growth of GNP |

|

|

1950-1975 |

2.86% |

|

1973-1995 |

2.48% |

|

1995-2004 |

2.20% |

In 2004 the UK’s GNP per hour worked was lower than in France, Germany, Denmark, Austria, Belgium, the Netherlands and Norway. As Nicholas Croft observed, the UK has “lower employment protection than elsewhere in Europe ... less product market regulation than in its European peer group ... However, it has a substantial productivity gap with the European leaders, and the rate of growth of UK labour productivity was only 2.20 percent per year 1995-2004 –, hardly tigerish”. [4]

The slow level of productivity growth translates into an even lower growth in real disposable income –, by only 1.3 percent a year over the past three years, and by just 0.8 percent last year. That was the lowest increase since the recession of 1982, and we are not currently in a recession. The figures for household income are even worse. This figure has been rising only 0.35 percent a year since 2001-2002, and is actually falling slightly this year. [5]

The result has been an increasing tendency for people to cover their personal spending by reliance on debt (figure 2).

|

Figure 2: Total UK personal debt |

|

This is the background to Brown’s attempt to hold public sector pay rises down to 2 percent or less, at a time when the Retail Price Index is over 4 percent.

But averages themselves to do not say what is happening to the mass of workers, since they include the incomes of the rich as well as the rest of the population. The disposable income figures, for instance, are boosted considerably by the huge bonuses paid to those on top salaries in the City and Canary Wharf.

One feature of New Labour which constitutes clear continuity with the Tory years is the high level of inequality.

|

Figure 3: Ratio of top 10 percent of incomes |

|||

|

UK |

France |

Germany |

US |

|---|---|---|---|

|

13.5 |

9.1 |

6.9 |

15.9 |

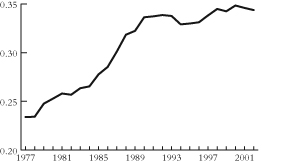

But not only is the level of inequality higher than under continental capitalism, it has also resumed its rise under New Labour. “Income inequality is slightly higher under most measures than it was in 1996-7”. [7] Figure 4 shows how the most widespread measure of inequality, the Gini coefficient, continued rising in the early Blair years. It then fell slightly (although only to the highest point under Major) and, after 2004, it started rising again. [8]

|

Figure 4: The UK Gini coefficient |

|

A mood of revulsion against Thatcherism brought New Labour to office in 1997, and in response the new government introduced some mild measures to counter the worst poverty. The combination of slow average household expenditure growth and increased inequality has had the effect of countering these measures. At no point during Brown’s spell as chancellor has a serious dent been made in the poverty figures.

One figure that even normally sycophantic media commentators have been unable to ignore is the numbers of children in poverty. This rose this year by 200,000, after falling a little (by just a sixth) between 1996-7 and 2004-5. Less commented on is that the proportion of working age non-parents in poverty has risen to a level above that of 1996-7. [9] The total number of working age adults on less than 60 percent of the median household income is now 7.1 million, as against 6.8 million ten years ago.

Reducing poverty is claimed as one of New Labour’s great achievements. Its other is that it has avoided a recession. This can, however, hardly be ascribed to any economic skills on Brown’s part. On taking office as chancellor ten years ago he scrapped one of the few powers left to the government to control the tempo of economic activity by handing control of interest rates to the Bank of England.

During the long boom from the 1940s to the mid-1970s governments claimed they could use a range of measures to influence the economy –, controls on bank lending, controls on consumer credit, controls over foreign exchange transactions, changes to consumer taxation, and raising and lowering government expenditure. Most of these measures were abandoned by the Thatcher and Major governments –, leading to complaints from left of centre critics that they were “one club golfers”, relying on interest rates alone. It was this power that Brown gave up, at the same time as ruling out for the first three years of his tenure any rise in government spending.

So the fact that Britain avoided the backwash of the 1997 Asian crisis and the 2001 US recession can hardly be ascribed to measures taken by Brown. His claim that Bank of England independence played a role should be laughable, since the independent Federal Reserve in the US could neither control the “irrational exuberance” of the dotcom bubble of the late 1990s nor ward off the recession which hit in 2001 (writing off $1,000 billion of new technology investment even before 9/11).

In fact, the most economically devastating feature of the Thatcher and Major years continued unchecked during Brown’s time in the Treasury –, the destruction of manufacturing jobs. Over the ten years some 1.5 million jobs have gone, a third of the 1996 total. By the beginning of this year there were only 2.97 million jobs in the UK’s manufacturing industries. [10] The decline averaged around 3,000 a week during Brown’s period “running” the economy. His “skills” have not prevented manufacturing from experiencing a stop-go pattern as marked as any in the past. Manufacturing output fell by 4 percent in 1991, only a little less than the 6 percent fall in the recession ten years earlier.

The recovery afterwards brought output back to roughly the same level as ten years ago –, and for that matter 20 years ago. There has not been absolute “deindustrialisation”. Restructuring has left certain industries intact –, and the workers in them as potentially powerful as ever. So while Rover has disappeared and Ford UK shrunk, the Nissan, Toyota and Honda plants produce nearly as many cars as the old firms ever did. [11] British capitalism retains some important manufacturing firms –, BAE, Rolls Royce and GlaxoSmithKline, for instance.

But this is little comfort for those who have lost their jobs. They face the same sense of devastation as in the Thatcher-Major period. So “almost a quarter of the workers at collapsed car maker MG Rover are still without jobs ... while one in five of those in work were earning the equivalent of the minimum wage”. [12] Only “16,000 new jobs have been created in former colliery areas against a target of 42,000 by 2012 after 250,000 jobs disappeared ... Average household incomes are £50 a week lower than regional averages and more than 250,000 people in coalfields are claiming incapacity benefits”. [13]

The decline of employment in the old industrial sectors finds expression in the secret story of Britain’s unemployment figures. According to the official story, the unemployment rate was 5.5 percent in March this year, with 1.69 million unemployed. In every one of Brown’s budget speeches in recent years this has been contrasted with figures in countries such as France, with its 9 percent rate.

However, what is missing from the official figures is something Labour made much of when in opposition –, the number of people thrown out of work who have been put on to disability benefits by dole office managers under orders to keep their figures down. In 2002 they accounted for 7 percent of the workforce (as compared to 0.2 percent in France). Studies suggest about a third of them “want work” but cannot get it. If these were included, Britain’s unemployment rate would increase “by 1.5 percent in the lowest unemployment areas, rising to 4.2 percent in the highest unemployment areas”. [14] This would still produce an unemployment rate a little lower than the French one, but not massively lower.

The main difference would seem to be that unemployment in France is more concentrated among the young, with 20 percent unemployed; in Britain the youth unemployment figure is closer to 10 percent, with half a million 18 to 24 year olds out of work, 70,000 more than in 1998. [15] At the same time Britain has a higher level of real (even if unmeasured) unemployment of around one million among those aged over 50.

For all Brown’s boasts about the “dynamism” of the British economy compared, for instance, to the French, “British business consistently spends less on R&D than its competitors in the US, France and Germany. In 2002, as part of its Lisbon Agenda, the European Council established a target for R&D investment in the EU of 3 percent of GDP by 2010. In 2003 the UK spent only 1.9 percent of GDP, a fall since the early 1990s, when it was around 2.1 percent of GDP”. [16]

But what explains the failure of job losses and recessions in manufacturing to feed over into the rest of the economy as they did in 1974, 1980 and 1991?

Here again, the “skills” of Brown are not responsible, nor are the wonders of deregulation and “labour market flexibility”. The major driving force has been the unexpected capacity of London to emerge as the major financial hub mediating between the US, Europe and the Far East. The slowdown in industrial accumulation in North America, Europe and Japan over the past 30 years has seen a flourishing of all sorts of speculative activity centred on stock exchanges, debt and, most recently, hedge funds. London’s geographic position has made it an ideal base for this.

“Finance and business services made up almost a third (33.0 percent) of the UK economy in 2004 with gross value added of £344.5 billion”, [17] and by 1999 new investment in this sector was already three or four times higher than in manufacturing and other industries. [18] Spending on financial skyscrapers and computers was deemed much more important than on producing goods that might satisfy human needs.

One by-product of this was an in increase in the number of jobs in this completely non-productive sector of the economy. “Financial and business services now account for about one in five jobs in the UK, compared with about one in ten in 1981”. [19] “Finance” refers to those who work directly for the banking sectors, and “business services” to a mix of related tasks such as legal, advertising, insurance, office cleaning, leasing, call centres, personnel and recruitment, and security.

Effectively, over the past ten years 1.5 million manufacturing jobs have disappeared, while between one million and 1.5 million “financial and business services” jobs have been created. Catering for the needs of these new workers has in turn provided a market for a host of other services –, taxis, fast food outlets and sandwich bars, city centre pubs, and so on –, many of them offering jobs at pay scales little better than the minimum wage. The new jobs on offer are rarely in the same locations as the old industries that have shrunk. Hence the expansion of employment in London and some provincial cities, while the old industrial areas have usually continued to decline. But even in London the jobs do not solve the problems of much of the old workforce.

An inflow of £53 billion in foreign direct investment into London (31 percent from the US and 16 percent from India) [20] has not stopped much lower than average levels of employment in boroughs such as Tower Hamlets, Hackney, Haringey, and Barking & Dagenham, and an unemployment rate for London as a whole of around 2 percent above the national average. [21] Those who put their trust in what one is tempted to call “the permanent finance economy”, including those who work for the mayor of London’s office, are ignoring its contradictory impact. It has served to veil a level of industrial employment decline greater than in most other advanced countries. But it is questionable whether it can do so when the next global recession takes place.

Industrial production proceeds by ups and downs. But it is through finance that the ups get turned into apparently magical bubbles that suddenly collapse overnight.

Foreign direct investment (FDI) accounts for more than a quarter of London’s economy and “foreign owned companies had created 42 percent of the capital’s economic growth between 1998 and 2004”, but “FDI companies are continually re-evaluating their presence here. More than half review their global strategy every three to five years, and 13 percent do so every year”. [22]

But it is not only London that is dependent on “finance and business services” in this way; so too are many provincial cities. The only way New Labour knows of reacting to this dependence is by shaping all its policies around catering for those who make the investment decisions.

Back in the mid-1990s, while still in opposition, Gordon Brown proclaimed that there was an alternative to old Keynesian attempts to use state intervention to smooth out the ups and downs of capitalism. He said the remedy lay in “post-neoclassical endogenous growth theory”. Such theory really amounts to the contention that all governments can do to ensure that capital accumulation takes place, and with it the growth of the economy and the “creation” of jobs, is to lubricate the wheels of the system through “supply side measures”. That entails deregulation, softening up the labour force through “labour market flexibility”, and training the potential workforce from the moment they are born to provide a pliant “human capital” input for production.

So instead of government intervention being able to ease the pain of capitalism through the mechanism of “demand management”, as was suggested by social democratic theorists of 50 years ago such as Anthony Crosland and John Strachey, it is to subordinate the whole lives of the mass of people to the system. Hence the exam assembly line for school students; the imposition of payment by results, and continual appraisal and inspections, on teachers and lecturers; the pressure on single parents, mothers of young children and disabled people to join the million and half people looking for jobs. Hence too the pressure to cut back by one means or another those services for the mass of the population that are unproductive in capitalist terms –, care for old people and the long term sick, legal aid and quality education for those to be slotted into unskilled jobs.

So it was that Brown did not only keep to Tory public spending plans for two years, as promised in 1997, but for three years. [23]

New Labour has, however, had one difficulty over the past ten years. Pushing through such “reforms” is difficult for any government trying to rule with a degree of consensus rather than force. Concessions have to be made that cut across the immediate interests of capital, if only to stand a chance of re-election. It is sometimes forgotten that New Labour lost three million votes in the 2001 election (before the mass disillusion over the war), essentially because holding back public expenditure created disaffection over the attacks on single parents and disabled people, and especially the NHS.

So Blair promised before the 2001 election to raise the percentage of GNP going on the health service to the European average. After the election Brown did finally boost public spending in an attempt to deal with the aftermath of the US recession, raising the percentage of GNP going to the NHS by 2.3 percent over four years. [24] But the implementation aimed to keep sections of capital on side through lucrative public-private partnership schemes, while the re-establishment of the internal market limited the degree to which resources were able to meet the needs of patients. In effect, with New Labour under pressure to deliver real reform, Brown insisted it was combined with neoliberal counter-reforms –, and still left the percentage of GNP spent on health about 1.2 percent behind France and Germany.

But this is in the past. Many of the problems Brown managed to evade for ten years could be closing in on him as he takes over the premiership from Blair. Inflation levels are beginning to create panic within the Monetary Policy Committee of the Bank of England, with four interest rate increases between August and May, and more expected. Someone who paid the average national price for a house five years ago will already have seen their repayment rise by about £20 a week over the past year.

The cost of finding any place to live at all is hitting manual and white collar working class and lower middle class people hard, with house prices quadrupling since 1996 and now six times average earnings –, 20 percent higher than before the last British housing crisis in the early 1990s.

People with mortgages have often managed to cope so far by borrowing still more. Debt to disposable income ratios in the UK are currently at 162.9 percent compared to 137.3 per cent in the US. There are already signs of the US house bubble bursting, with some mortgage lenders going bust, threats to repossess some two million homes and fears in the business press of a new recession. Further increases in interest rates could lead to the same danger here.

The government has left itself with only one weapon capable of placating the Monetary Policy Committee and restricting further interest rises –, holding back public expenditure. Hence the pressure on NHS trusts to cut back, with the sacking of nurses and the shortage of jobs for newly qualified doctors. Hence too the attempt to impose a 2 percent limit on wage increases in the public sector at a time when the retail price index is over 4 percent, and likely to go higher with increased mortgage costs.

The “miracle”, like every other in Britain since the 1970s, is likely to end in tears. Let us hope they are not ours but Gordon Brown’s.

1. Brown, 2004.

2. McMorrow and Roeger, 2007, p.82.

3. Croft, 2007, p.70.

4. Croft, 2007, p.72.

5. Giles, 2007.

6. Panic, 2007.

7. Institute for Fiscal Studies, 2007.

8. Institute for Fiscal Studies, 2007, p.19.

9. Institute for Fiscal Studies, 2007, p.29.

10. Office for National Statistics figure.

11. Car production reached an all-time peak of 1,750,000 in 1999; it is now down to just over 1,500,000. See SMTT, 2006, and Harper, 2006, table 5.2.

12. According to an Amicus survey of 1,750 union members. See Milner, 2007.

13. Report by SQW consultants, summarised in Financial Times, 3 March 2007.

14. Webster, 2002.

15. Field, 2007.

16. Nesta, 2006.

17. ONS, 2006.

18. See the chart in Millward, 2003, p.249.

19. ONS, 2002.

20. Financial Times, 27 April 2007.

21. Seager, 2005.

22. Michael Charlton, chief executive of Think London, an FDI agency, quoted in the Financial Times, 27 April 2007.

23. See Emmerson and Frayne, 2002.

24. Office of Health Economics press release, 26 February 2007.

Brown, Gordon, 2004, budget speech, 17 March 2004.

Croft, Nicholas, 2007, Recent European Economic Growth: Why Can’t it be a Return to the Golden Age, National Institute Economic Review, January 2007.

Emmerson, Carl, and Christine Frayne, 2002, Giving us a Steer.

Field, Frank, 2007, the Guardian website.

Giles, Chris, 2007, Brown’s Paradox: a Tale of Two Economies, Financial Times, 20 March 2007.

Harper, David (ed.), 2006, Economic Trends Annual Supplement, Office for National Statistics.

Institute for Fiscal Studies, 2007, Poverty and Inequality in UK: 2007.

McMorrow, Kieran, and Werner Roeger, 2007, Analysis of European Growth Rates, National Institute Economic Review, January 2007.

Milner, Mark, 2007, A Quarter of Rover Workers Still Unemployed, the Guardian, 5 February 2007.

Millward, Robert, 2003, The Rise of the Service Economy, in Roderick Floud and Paul Johnson (eds.), The Cambridge Economic History of Modern Britain, volume three (Cambridge University Press).

Nesta, 2006, The Innovation Gap, October 2006.

ONS, 2002, The Jobs People Do.

ONS, 2006, Spending on Eating Out Overtakes Meals at Home.

Panic, M., 2007, Commentary, Cambridge Journal of Economics, January 2007.

Seager, Ashley, 2005, London Revealed as Britain’s Worst Employment Blackspot, the Guardian, 28 October 2005.

SMTT, 2006, UK New Car Registrations at Q2/2006.

Webster, David, 2002, Unemployment: How Official Statistics Distort Analysis and Policy, and Why, Radical Statistics 79/80 (Summer/Winter 2002).

Last updated on 14 January 2010